By GARRY RAYNO, InDepthNH.org

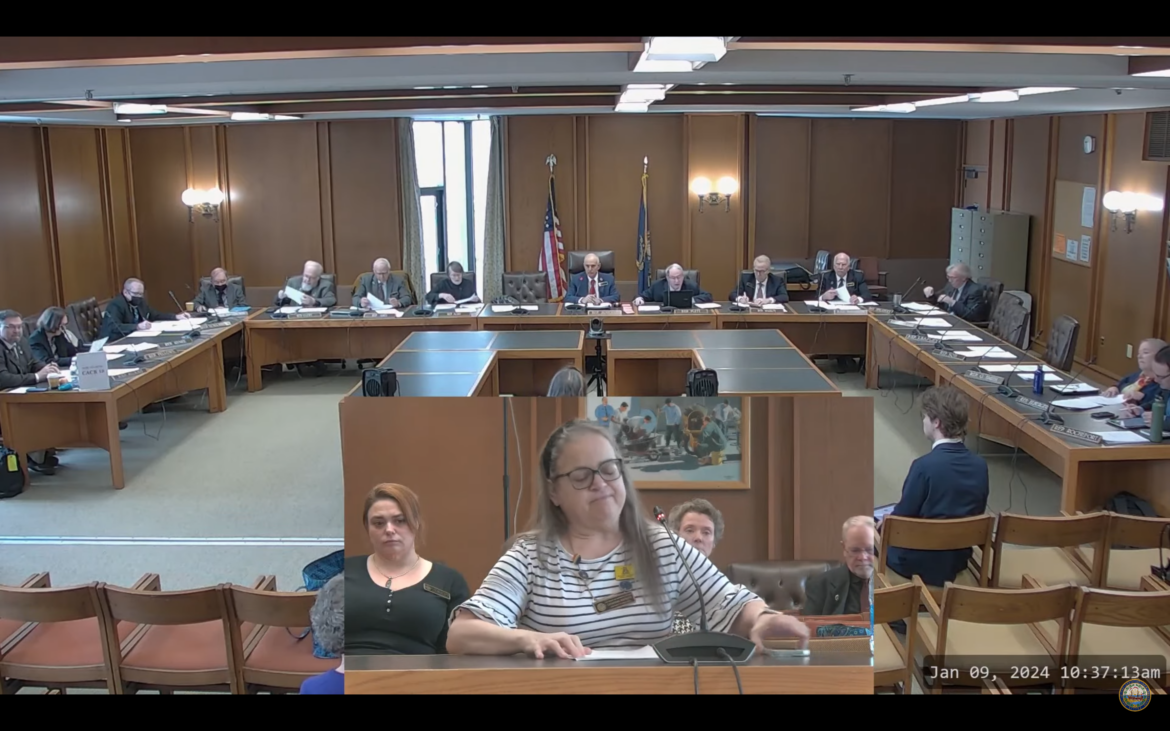

CONCORD — A proposed constitutional amendment requiring churches to pay state and local property taxes had little support before the House Ways and Means Committee Tuesday.

The prime sponsor of the proposed amendment, Rep. Catherine Sofikitis, D-Nashua, was not optimistic about a positive recommendation from the committee, but said she viewed her proposal as the beginning of a dialogue to discuss the policy and to begin moving away from the divisions plaguing the country.

“Faith-based groups are using their tax exempt status to reach too many people and give themselves too much political power,” Sofikitis said. “People do not have the same crack at the pie.”

She used as examples the recent Supreme Court decision taking away a woman’s reproductive rights with the backing of religious organizations and the organizations backing school vouchers telling parents to take their kids out of public schools because they are failing, take money away from the public schools.

“I just want people to stay in their own sandbox, stay in the same lane,” Sofikitis said, “and stop dividing us up.”

She said the founding fathers were wise to ensure the separation of church and state, and she wants to represent the people that are not represented in Concord by lobbyists for churches and nonprofits.

Sofikitis said the wall between church and state has been blurred and blurred and blurred in recent years.

Rep. Fred Plett, R-Goffstown, noted that public schools are not subject to taxes but she wanted to make church schools taxable.

Sofikitis said public schools are supported with the taxes parents and others pay. “Taxation is not theft,” she said. “For me taxation is a sacred ability for society to work together.”

The current situation allows certain groups to get all the breaks while unrepresented people do not, she said.

“We need to step back from the sound bytes and work together for sound public policy for all, Sofikitis said.

Rep. Susan Almy, D-Lebanon, said she is more troubled by the whole tax exempt system of non-profits not paying taxes while some “are a little bit too stretched and do not help anybody but the people in it, but you carve out just the religious ones.”

Sofikitis noted her proposal would probably go nowhere, but she wants to help the people who are not represented in Concord and to begin a dialogue.

Rep. Sally Fellows, D-Holderness, said she supports the general concept but that many more details need to be added. It is difficult to define what is a private school and a religious organization under the bill before the committee, she said.

“We need to better understand what this will mean in the long run,” Fellows said.

Meredith Cook, chancellor of the Diocese of Manchester, opposed the bill noting Catholic Charities is the largest provider of charitable assistance in the state outside of state government.

She listed assistance programs and the groups helped by the diocese from the homeless to the elderly and the most vulnerable.

“If that floor or backbone was gone, the gap state and local government would have to make up would be grave,” Cook told the committee.

She said the diocese will not hide its opposition to abortion, but the church advocates for the dignity of everyone from birth to death and everything in the middle.

Cook noted the bill does not seek to tax all nonprofits, some of whom speak in Concord on the same issues as the diocese, just religious organizations.

That would mean St. Joseph’s Hospital in Nashua would be taxed, but Southern New Hampshire Health would not, and Saint Anselm College would be taxed but not Southern New Hampshire University.

Several committee members noted they belong to small churches that struggle to get by now, and if they were taxed they would not be viable and that would end any help they provide to communities.

Rep. Cyril Aures, R-Chichester, said churches have taken care of the poor for hundreds of years and for a lot of them the door swings both ways as many fly rainbow flags.

And he wondered if the people in the State House were willing to pick up the slack for what churches do if they are taxed and no longer can provide assistance.

Rep. Susan Elberger, D-Nashua, noted that some of the churches require those they help to be proselytize.

Aures said his understanding of proselytizing is actually “teaching a man or a woman to fish so as not having to feed them everyday.”

He said Grace Capital asks those they help to be there for training to help lift themselves out of poverty.

James Thibault, chair of the NH Legislative Youth Advisory Council, said his organization unanimously voted to oppose the bill, noting it is very diverse and the members believe religious organizations do a lot of good.

Between on-line filings and a signup sheet in the committee room, three people supported the bill and 20 opposed it.

The committee will hold a work session on the proposed amendment before deciding on a recommendation.

A proposed constitutional amendment requires a three-fifths majority of both the House and Senate to be placed on the next general election ballot, and a two-thirds majority of those voting in that election to change the constitution.

Garry Rayno may be reached at garry.rayno@yahoo.com.