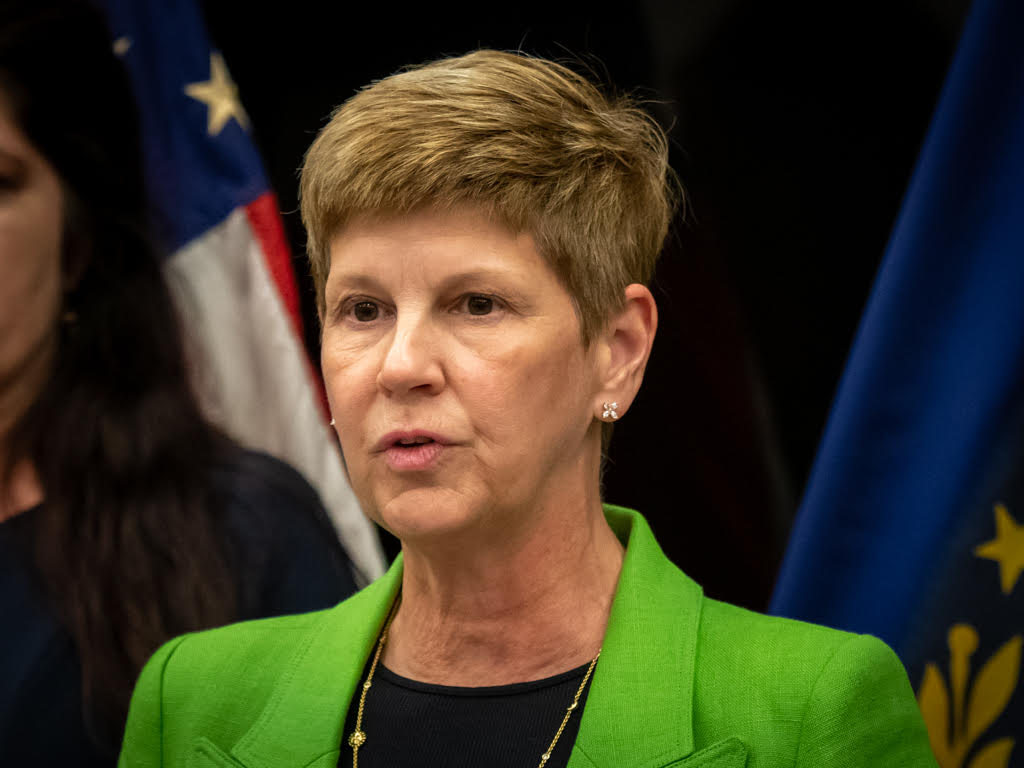

CONCORD – A Derry woman pleaded guilty today in federal court for her role in attempting to fraudulently obtain $2.5 million in COVID-19 pandemic relief funds, U.S. Attorney Jane E. Young announces.

Tammy Dodge, 43, pleaded guilty to bank fraud. U.S. District Court Judge Paul J. Barbadoro scheduled sentencing for June 10, 2024. Dodge’s husband and co-conspirator, David Dodge, pled guilty on February 20, 2024, and is scheduled to be sentenced on May 29, 2024.

The Dodges claimed to own or control multiple businesses in New Hampshire and Massachusetts, including Teacher Tammy (a/k/a Teacher Tammy’s), Optimized Operations, and Business Done Right. In reality, these companies had no operations and served no business purpose.

In total, Tammy Dodge and her husband submitted 30 fraudulent applications for Paycheck Protection Program (PPP) loans from private lenders, Economic Injury Disaster Loans (EIDLs) from the Small Business Administration, and pandemic relief grants from the New Hampshire Governor’s Office for Emergency Relief and Recovery (GOFERR) and the Massachusetts Growth Capital Corporation (MGCC).

Tammy Dodge used fake supporting documents in the applications. For example, on January 25, 2021, she applied for a $35,833 PPP loan for Teacher Tammy. She provided the lender a purported check and February 2020 bank statement for a TD Bank account in the name of Teacher Tammy. However, the account was under the defendant’s own name and did not even exist until June 2020. The defendant also provided fake tax documents.

Overall, because lenders detected most of the fraudulent applications, the Dodges were able to obtain $219,323.34 out of the approximately $2.5 million they sought. They misused some of the fraudulently obtained funds.

The charging statute provides a sentence of no greater than 30 years in prison, 5 years of supervised release, and a fine of $1 million. Sentences are imposed by a federal district court judge based upon the U.S. Sentencing Guidelines and statutes which govern the determination of a sentence in a criminal case.

The Treasury Inspector General for Tax Administration led the investigation. Assistant U.S. Attorney Alexander S. Chen is prosecuting the case.

During the early part of the coronavirus pandemic, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act included multiple relief provisions to help the millions of Americans and many small businesses adversely affected by the pandemic, including the Paycheck Protection Program (PPP). Private lenders could participate in the PPP. The loans, which were supposed to be used for payroll, were fully guaranteed by the government. If borrowers used the PPP loans for payroll and other approved expenses as intended, they could apply for loan forgiveness. The CARES Act also opened up the Small Business Administration’s (SBA) Economic Injury Disaster Loan (EIDL) program. As with PPP loans, EIDL loans were supposed to be used for payroll and other business expenses such as rent and mortgage.

On May 17, 2021, the Attorney General established the COVID-19 Fraud Enforcement Task Force to marshal the resources of the Department of Justice in partnership with agencies across government to enhance efforts to combat and prevent pandemic-related fraud. The Task Force bolsters efforts to investigate and prosecute the most culpable domestic and international criminal actors and assists agencies tasked with administering relief programs to prevent fraud by, among other methods, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts. For more information on the Department’s response to the pandemic, please visit https://www.justice.gov/coronavirus

Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justice’s National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at: https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.