By GARRY RAYNO, InDepthNH.org

CONCORD — Despite politicians’ claims of business tax rate cuts spurring the state’s economy, a recent study indicates the state’s economy would grow faster by putting additional money in the hands of low- to moderate-income residents.

The issue brief by the New Hampshire Fiscal Policy Institute proposes that business tax rate cuts cost the state between $496 million and $729 million in revenue since they began in 2015.

The brief contends that money would have provided a greater boost to job creation and economic growth by providing services and benefits to low- and moderate-income residents who will spend the money locally.

With the small rate reductions for businesses, particularly large multinational corporations who pay the largest share of the state’s Business Profits Tax, the study shows, a large share of the saved money flows out of state and out of the country as dividends and higher salaries to employees already at the top of the pay scale.

New Hampshire depends on business taxes more than any other state to fund general government operations at 31 percent of all revenues, consequently business tax revenues are critical in paying for state services, according to the brief.

New Jersey is second with 14 percent.

Since 2015, the business profits tax rate has dropped from 8.5 percent to 7.5 percent and the business enterprise tax rate has dropped from .75 percent to .55 percent.

New Hampshire, like most other states in the country, has seen its business tax revenue expand significantly since the middle of the last decade and the policy institute sought to determine if the increase was tied to the rate reductions or if it was due to other factors.

“This Issue Brief assesses the extent to which revenue was gained, or lost, by the reductions in the BPT and BET rates. It includes a review of relevant national and multi-state research, a review of factors likely generating the three recent increases in business tax receipts between 2015 and 2022, an assessment of the interaction between the business tax rates and the economy in New Hampshire, and an evaluation of the revenue impacts of the BPT and BET rate reductions between 2015 and 2022,” according to Phil Sletten, Research Director of the institute.

State tax policy since 2015 has been to reduce business tax rates to be more competitive with rates in surrounding states and more recently to eliminate the interest and dividends tax. Republicans claim the two actions will spur the economy, create jobs and produce greater revenue in the future or what is known as trickle down economics, which to date has proven to be an accelerator of pushing wealth to the top tiers while creating greater income disparity.

Sletten cites a number of national studies that argue reducing business tax rates has little effect on the economy except in specific instances like a recession.

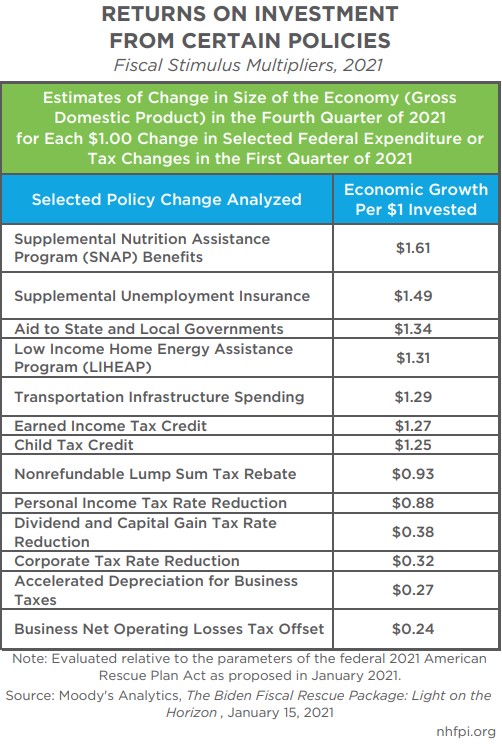

Moody Analytics in a 2021 study found a dollar invested in the Supplemental Nutrition Assistance Program (SNAP) would boost the size of the overall economy by $1.61, as individuals would spend their benefit on food in the local economy. Unemployment insurance would boost the economy by $1.49 per dollar invested over the same time period, because the money would be used quickly in the local economy.

On the other hand, Moody Analytics estimated a dividend and capital gain tax rate reduction would generate 38 cents for each dollar of revenue, while a corporate tax rate reduction would generate 32 cents, and a business net operating loss tax offset would return 24 cents on the dollar.

“These estimates are similar to Moody’s analyses of the economic impacts of similar policies for 2009 and 2015, when federal corporate tax rate reductions were estimated to generate 32 cents and 30 cents, respectively, per dollar invested,” Sletten writes.

Similarly, the U.S. Congressional Research Service examined top federal income and capital gains tax rates between 1945 and 2010 and found little or no relationship between savings, investments, and growth in productivity, but did identify that the national share of income accruing to labor, rather than capital, decreased with lower maximum tax rates.

The research service also found more income was concentrated for the highest-income households in environments with lower maximum income and capital gains tax rates.

The Tax Foundation in 2013 noted tax reforms in some situations can lead to higher revenues even when individual rate reductions are included, but also said “Can a tax cut pay for itself? Most economists would probably agree that the answer is generally ‘rarely, but usually not.’”

Looking at the impact of rate cuts on the local state economy, the institute’s study cites a National Tax Journal article saying several studies show “no statistically significant negative effects of corporate tax rates on economic growth, while some research suggests higher property taxes have negative impacts.”

Sletten notes the Council on State Taxation, says about half (49.7 percent) of all state and local tax dollars paid by New Hampshire businesses during fiscal year 2021 were property taxes, while just over a quarter (26.0 percent) were paid to the BPT and the BET.

The report gives three reasons for the growth in business tax revenues, the first is from pent up economic activity following the great recession at the beginning of the last decade.

Sletten notes the state had slow economic growth between 2011 and 2013, but began to pick up in 2014 adding jobs which peaked at the beginning of 2016.

“This increase in economic activity, and the timing of other tax receipts, suggest economic growth spurring a rise in business tax revenues preceded the rate reductions that took effect in Tax Year 2016, rather than being enabled by more resources available to businesses after they took effect,” Sletten writes.

The second reason for significant growth in the business tax revenues was a change in federal corporate taxes in 2017 under the federal Tax Cuts and Jobs Act that encouraged multinational corporations to return assets to U.S. affiliate companies, rather than hold them overseas.

Business tax revenue in New Hampshire between fiscal years 2017 and 2019 grew 26 percent, while federal data shows combined state corporate tax revenues increased nationwide by 34 percent.

Neighboring states also had similar revenue growth rising 44 percent in Maine, 34 percent in Massachusetts, and 35 percent in Vermont, according to the brief.

The third reason for the increase in business tax revenue according to Sletten was the economic rebound from the pandemic due to federal stimulus money to states and individuals and skyrocketing corporate profits.

But the brief notes the reductions to rates are not enough on their own to drive job growth, as a corporation owing $1 million in business taxes would see a reduction of about $33,000, not enough to pay for a new employee.

“Controlling for economic growth in New England shows there is no statistically significant relationship between the BPT rate and overall economic growth in New Hampshire relative to New England,” Sletten writes. “The BPT rates between 1970 and 1997 only appear to explain 0.7 percent of the variation in the difference between New Hampshire’s economic growth and overall economic growth in New England, and there is not a statistically significant relationship between BPT rates and economic growth.”

Sletten said their analysis indicates the rate reductions at a minimum prevented the state from collecting $496 million and a maximum $729 million, noting the entire mental health budget for the Department of Health and Human Services during the same time period was $517.5 million.

The additional “revenue could have eliminated the Statewide Education Property Tax in its current form for one or two years, which may have provided more effective economic stimulus for the New Hampshire economy than corporate tax rate reductions,” he said. “Alternatively, the state could have doubled the state budget contribution to the University System each year as early as 2019, or doubled the current budget of the Veterans’ Home starting as early as 2018, with additional funds remaining in future years relative to the growing impacts of the tax rate reductions over time.”

The governor, like others before him, likes to take credit for cutting taxes and growing the economy, but the study done by the New Hampshire Fiscal Policy Institute indicates there are far better ways to spur growth and create jobs.

Programs for the poor and middle-class residents would produce much more economic activity as would making serious reductions in property taxes including those for businesses with half their state tax burden property taxes.

But that has not been the “New Hampshire Advantage,” which these days appears to be an advantage to a very small percentage of the state’s residents who really don’t need any help from the state’s taxpayers.

Garry Rayno may be reached at garry.rayno@yahoo.com.

Distant Dome by veteran journalist Garry Rayno explores a broader perspective on the State House and state happenings for InDepthNH.org. Over his three-decade career, Rayno covered the NH State House for the New Hampshire Union Leader and Foster’s Daily Democrat. During his career, his coverage spanned the news spectrum, from local planning, school and select boards, to national issues such as electric industry deregulation and Presidential primaries. Rayno lives with his wife Carolyn in New London.