Sign up for InDepthNH.org’s Power to the People is NH Consumer Advocate D. Maurice Kreis’ column about what happens long before you turn on the lights. Kreis and his staff of four represent the interests of residential utility customers before the NH Public Utilities Commission and elsewhere. InDepthNH.org co-publishes Power to the People with Manchester Ink Link.

Power to the People is NH Consumer Advocate D. Maurice Kreis’ column about what happens long before you turn on the lights. Kreis and his staff of four represent the interests of residential utility customers before the NH Public Utilities Commission and elsewhere. InDepthNH.org co-publishes Power to the People with Manchester Ink Link. By D. Maurice Kreis,

Power to the People

Power to the People

“We finance fun!” So proclaims an e-mail recently sent by a major credit union in New Hampshire, urging its members to borrow money for recreational vehicles, ATVs, jet skis, motorcycles or “virtually anything that moves.” It’s enough to make a ratepayer advocate cry.

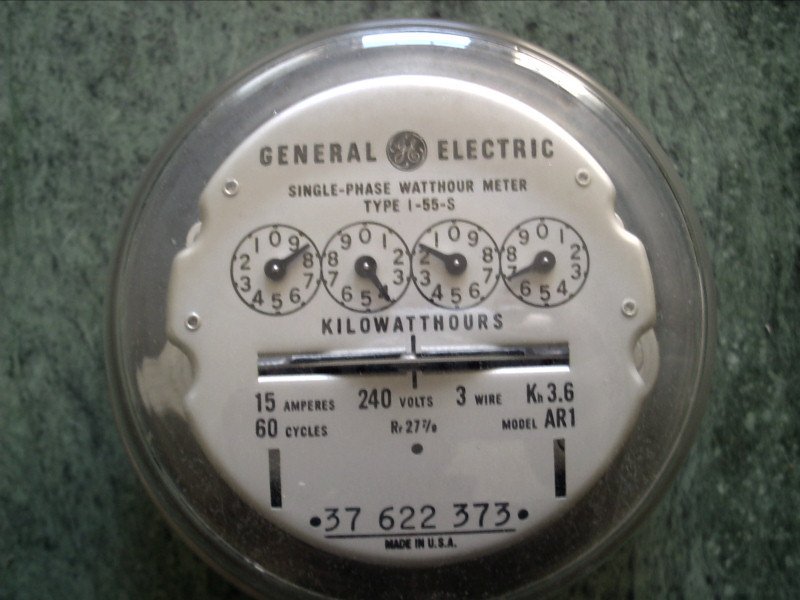

Those tears are falling on my copy of the agreements New Hampshire’s electric utilities have with three banks and two credit unions, including the one that sent the e-mail. Under those agreements, the utilities use ratepayer money (collected via the System Benefits Charge on everyone’s electric bill) to subsidize certain consumer loans made by the financial institutions.

Those tears are falling on my copy of the agreements New Hampshire’s electric utilities have with three banks and two credit unions, including the one that sent the e-mail. Under those agreements, the utilities use ratepayer money (collected via the System Benefits Charge on everyone’s electric bill) to subsidize certain consumer loans made by the financial institutions.

The purpose of the subsidies is to reduce the interest rate to an alluring 2 percent on loans made to homeowners who use the money to make their dwelling places more energy-efficient.

Experiencing the Kancamagus Highway via motorcycle is exhilarating. But what would provide year-round excitement is longterm savings on my energy bill through the achievement of a dream officially sanctioned by the Public Utilities Commission (PUC) last year – that of all cost-effective energy efficiency.

YouTube

The PUC approved that objective in connection with making New Hampshire the last state in New England to adopt an Energy Efficiency Resource Standard (EERS). Since at least 2001, our utilities have collected modest sums via the System Benefits Charge and devoted them to helping customers, big and small, use less energy to meet their business and personal needs.

Switching to an EERS means that beginning in January, we’ll set realistic and modest targets for reducing the amount of electricity and natural gas sold to customers and fund the energy efficiency programs needed to make it happen.

How realistic and modest? We’re talking about reducing electricity sales by slightly more than three percent over three years.

That’s less than half the goal applicable to the EERS in Massachusetts, the top state in the nation according to the annual scorecard of the American Council for an Energy Efficient Economy. But it is an important step nevertheless in the effort to address the concerns about energy costs perennially and appropriately being raised by organizations like the Business and Industry Association and elected officials of both major parties.

But here’s the thing.

There are thousands of homes in New Hampshire that could use $10,000 worth of energy efficiency retrofit work – new insulation, better windows, new lighting, a better furnace, improved ductwork, and lots of other prosaic stuff. There’s no reason to do it unless it’s cost-effective – meaning a net monthly savings to the affected customer and (taking ratepayer subsidies into account) a net benefit to all ratepayers.

And even if it’s cost-effective there’s no way to do it unless the homeowner can come up with her share of the costs.

New Hampshire’s residential utility customers are therefore in desperate need of money they can borrow to finance their share of cost-efficient energy efficiency projects. The loan buy-downs arranged by utilities with those five financial institutions are a great start, but it is a tiny program.

For all of last year, there were just 42 such loans. The credit unions and banks are not obliged to do anything other than apply their usual lending standards, which mean those who need energy efficiency the most are the least likely to get approved.

One would think that credit unions, as financial services cooperatives owned by their customers, would be eager to advance the interests of their members by promoting energy efficiency loans with gusto.

In Vermont, the statewide credit union VSECU is doing just that. Here in New Hampshire, credit unions are skittish about making unsecured loans. You can repossess an ATV or a jet ski, but not an errant borrower’s home insulation. Risk aversion, not a penchant for fun, accounts for why credit unions are spurning this opportunity to meet a pressing need of their members.

Hesitant utilities

The utilities themselves could step up to the plate, but have hesitated so far. We know this because the state’s Energy Efficiency and Sustainable Energy (EESE) Board has seen the draft edition of their three-year plan to implement the Energy Efficiency Resource Standard. A committee of the EESE Board spent seven intense weeks meeting with the utilities to discuss their plan. The utilities made clear they prefer business as usual when it comes to making loans for energy efficiency available to consumers.

On September 1, the utilities will file the final edition of their three-year EERS Plan with the PUC. One can hope they will heed the earnest calls from members of the EESE Board to make consumer loans a meaningful part of ratepayer-subsidized energy efficiency programs in New Hampshire.

But if the past is any indication, the utilities will yet again remind everyone that they’re not banks and thus cannot be expected to help their customers in this fashion. They tend to say this even though they’d be lending ratepayer rather than shareholder money – and could even collect the loan payments via each borrower’s monthly utility bill.

Potential solution

Ultimately, New Hampshire will probably need to do what Connecticut and several other states have done and create an entirely new nonprofit financial institution to help consumers obtain the energy efficiency improvements they need to get ahead of their utility bills.

Sure, it’s fun to zip around on whatever motorized toy your credit union is eager to finance for you, but winter is coming and, with it, big utility bills. Doing something big about that would be the most fun of all.

PSNH to be Restructured at Last – Maybe