By GARRY RAYNO , InDepthNH.org

CONCORD — The federal dollars that help prevent a debilitating recession fueled state revenues, but now more than half of the states — including New Hampshire — are experiencing lower revenues than the year before.

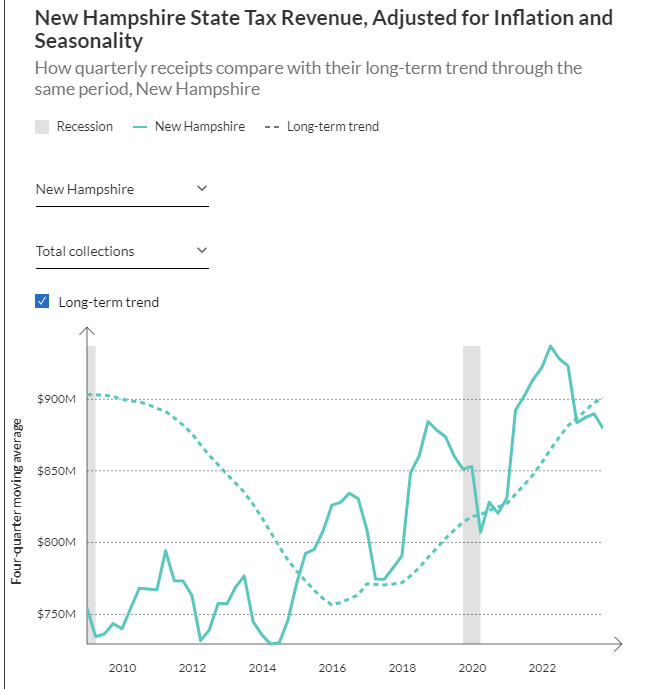

According to a report by the Pew Charitable Trusts released this week, while states experienced an unprecedented jump in revenues due to the federal influx of billions of dollars, they are now, for the first time outside of a recession, seeing “real revenue” decrease from the year before.

Nationwide, the decrease in real revenue, which is inflation adjusted, began late in fiscal year 2022 and continued in the next two fiscal years which ended June 30.

As the 2023 fiscal year closed, nationwide the total collections of state revenues were 3.2 percent below long term trends over the last 15 years, the highest since 2014 during the recovery from the Great Recession at the end of the prior decade.

New Hampshire was one of 28 states who were below the long-term trend at 2.3 percent along with the other New England states except Maine which was 2.4 percent above the trend and Rhode Island at 1.8 percent above.

Connecticut had the second worst decline in the country at 8.2 percent, followed by Massachusetts at 3.8 percent and Vermont at 2.6 percent.

California was hit by the worst decline at 13.9 percent while Alaska had the greatest growth over the trend at 225 percent, followed by Wyoming and New Mexico, both over 20 percent above the long term trend.

In contrast, the peak in revenue collections over the trend was in the second quarter of fiscal 2022 at 14.9 percent for all states combined.

In the 2024 fiscal year, the report notes, five states reported revenue shortfalls: California, Alaska, Illinois, Massachusetts and NewYork, and others are predicting possible shortfalls in the year ahead.

The report done by Justin Theal, a senior officer, and Alexandre Fall, a senior associate with The Pew Charitable Trusts’ Fiscal 50 project, looked at three major revenue sources for states: sales, personal income and corporate taxes compared to their long-term trend.

In New Hampshire, the news for budget writers working next spring on the state’s next biennium budget is not good.

While New Hampshire has no general sales tax, it does have the interest and dividends tax, which taxes personal income from interest and dividends, and corporate taxes, the business profits and business enterprise taxes.

One of the things many states did with their two- or three-year revenue is cut tax rates, which New Hampshire lawmakers did for business taxes and the rooms and meals tax, and they voted to phase out the interest and dividends tax, with the prohibition accelerated to end after Dec. 31.

According to the report, the interest and dividend tax in the fourth quarter of fiscal 2023 was 7.7 percent or $2.89 million, higher than the state’s 15-year trend, while nationally the personal income taxes were 12.4 percent below their long-term trend.

New Hampshire was one of nine out of 43 states that outperformed their long-term trend for the levy.

The last two fiscal years, the tax is one of the reasons the state has retained a surplus as other tax collections have slowed, but it goes away in four months.

In fiscal 2024, the tax produced $184.3 million, which was 24 percent more than estimates and continued to perform well during the first month of the 2025 fiscal year.

New Hampshire’s single largest revenue source is business taxes, and according to the report at the end of the fourth quarter of 2023 it was 9.8 percent higher than its long term trend or $29.2 million more than the trend.

Nationally, corporate income tax collections were 19 percent higher their long-term trend as all but eight states were outperforming their long-term trend.

For New Hampshire, that is likely to mean a continued decline in business tax revenues as the state experienced last fiscal year as the state returns to its long-term trend.

Much of the windfall for New Hampshire has come from profits from multinational conglomerates who were largely unaffected by the pandemic recession and many made record profits.

“As the nation moves past its brief but extraordinary period of widespread surpluses and historic revenue growth,” the authors write, “policymakers will likely have less new money to fund policy priorities such as tax cuts, increased funding for public services, and recession preparedness.”

Overall the authors question if states will be able to afford the budgetary commitments they made to tax cuts and wage increases over the past three years, noting that fiscal 2023 and 2024 showed the largest tax cuts ever recorded by states along with 37 states that raised workers’ salaries as New Hampshire did.

New Hampshire used and continues to use the federal relief and recovery money for grants to businesses and nonprofits; increases to unemployment benefits; increase wages to hard hit areas such as child and long-term care, health care, and emergency services; improving healthcare facilities; tax cuts; improving and constructing facilities that house state agencies and services; housing initiatives, and for town, school and county projects.

While New Hampshire ended the 2024 fiscal year with a revenue surplus, it was considerably lower than the previous year which topped $500 million.

Garry Rayno may be reached at garry..rayno@yahoo.com.