By PHIL SLETTEN, NH Fiscal Policy Institute

New Hampshire State revenues collected in May matched the amount State Budget writers planned to collect, but met that target in a manner suggesting potential challenges for future revenues. Key sources of revenue growth in recent years, specifically the State’s business taxes and the Real Estate Transfer Tax, have been slipping behind expectations, and the revenue sources currently generating surpluses are likely to be temporary.

Combined revenues for the General Fund and the Education Trust Fund in May were $141.7 million, effectively matching the State Revenue Plan for May of $141.2 million. May is not a key month for State revenues, as significant business tax revenues are paid on a quarterly basis, and most of the revenue associated with annual tax returns for 2023 were paid earlier in 2024. With revenues matching planned amounts in May, the total surplus reached $141.9 million (5.0 percent above expectations) combined for these two funds with one month left in State Fiscal Year (SFY) 2024.

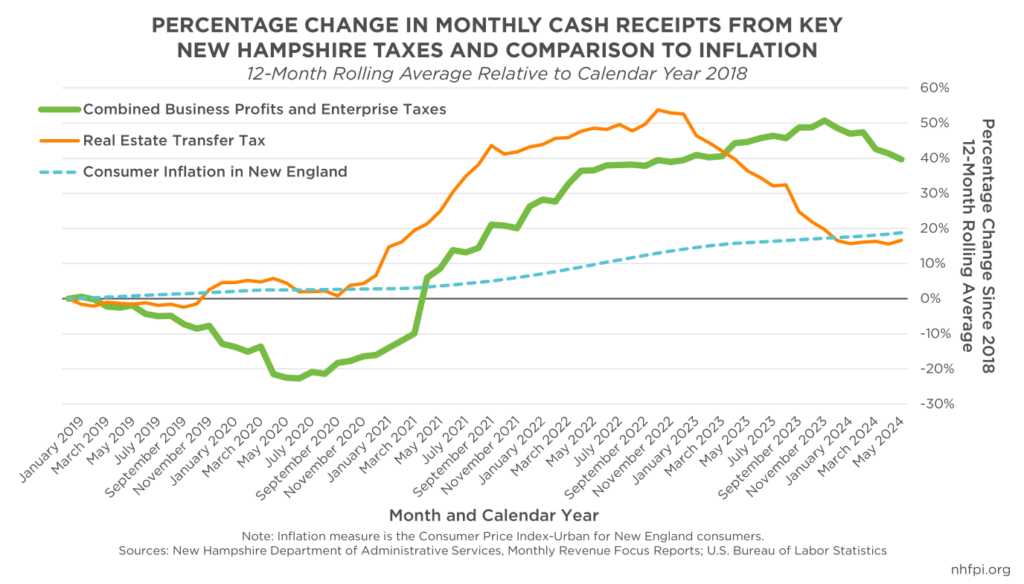

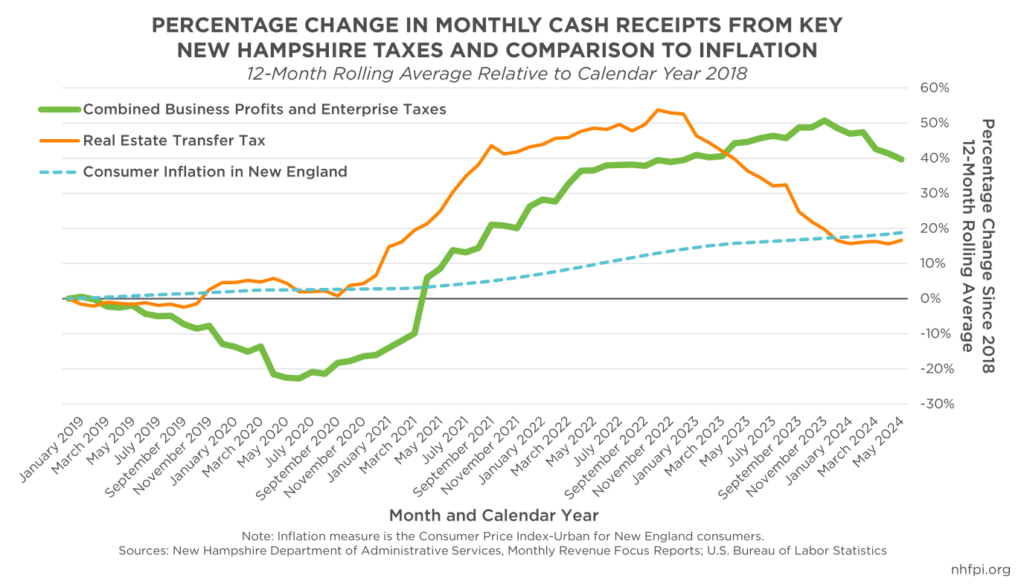

The two largest drivers of State tax revenue growth in the three years following SFY 2019, encompassing the start of the COVID-19 pandemic, were the combined business taxes and the Real Estate Transfer Tax. Combined business tax revenues alone brought in $453.3 million (56.2 percent) more revenue in SFY 2023 than in SFY 2019. Real Estate Transfer Tax revenues peaked in SFY 2022, rising $79.7 million (52.1 percent) higher than the revenues collected during SFY 2019. Both these revenue sources have slowed substantially. The State faces a severe housing shortage, limiting the number of taxable transactions under the Real Estate Transfer Tax even as price increases push up revenues. National corporate profit growth has plateaued, and reductions in New Hampshire’s business tax rates have also reduced revenue over time.

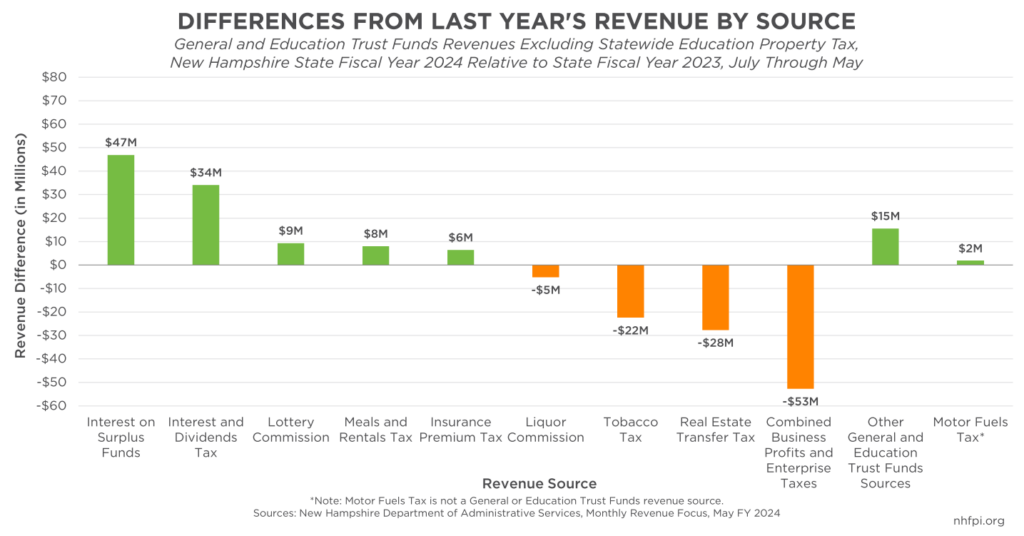

The 12-month rolling average of Real Estate Transfer Tax revenues collected by the State has fallen behind consumer inflation in New England when both are measured relative to 2018. This suggests the Real Estate Transfer Tax, despite its substantial growth in prior years, now delivers less purchasing power to public coffers than it did in 2018. The decline in Real Estate Transfer Tax revenues may have slowed or stopped in recent months, as increased prices and an inventory for purchase that is not declining as quickly as in recent years may stabilize total transaction values. While Real Estate Transfer Tax revenues in May were $2.7 million (16.9 percent) below the State Revenue Plan’s expectations, they were $1.7 million (14.7 percent) above May 2023 revenues, and both the number of transactions and transaction values were reported to be higher.

Business tax collections in May, however, slid behind both the planned amount and the prior year by about 34 percent. For SFY 2024 thus far, combined business tax revenues were $17.9 million (1.7 percent) below the State Revenue Plan, and $52.7 million (4.8 percent) below the prior year. While May is not a key month for business tax revenues, June’s collections are typically quite significant and will provide more insights.

Offsetting these deficits, revenue growth and the State’s revenue surplus continue to be generated largely by two temporary revenue sources. The first is interest paid to the State on its nearly, as of the end of April 2024, $2.75 billion in operating cash balance. The high cash balance is due in part to recent surpluses and in part to one-time federal funds that have come to the State associated with U.S. Congress’s response to the COVID-19 pandemic. The second is higher revenues from the Interest and Dividends Tax, which is a tax on income generated from owning wealth and paid largely by higher-income Granite Staters. Both the interest on State cash holdings and Interest and Dividends Tax revenues have been boosted by higher interest rates, which are likely temporary. More directly impacting future revenue changes from these sources, the Interest and Dividends Tax is due to be repealed next year under current law, and the State is likely to spend down its cash holdings over time, including ahead of key federal deadlines, reducing interest payments on cash holdings.

While key revenue sources may perform better in the future than current trends suggest, the sources of State revenue growth have shifted substantially over the last two fiscal years. Business tax revenues, which the State has relied upon for revenue growth during most of the last decade, appear to be slowing, and Real Estate Transfer Tax revenues have partially deflated. The current revenue surplus is supported by two sources that are likely temporary, and other revenues appear to have either limited or mixed revenue growth relative to last year’s figures. Policymakers seeking to fund services may face greater challenges in 2025 than they have during most of the prior ten years while crafting the State Budget.

– Phil Sletten, Research Director