Read full report here: https://www.pewtrusts.org/en/research-and-analysis/reports/2023/12/pandemic-aid-how-states-safeguarded-against-future-budget-challenges

By GARRY RAYNO, InDepthNH.org

CONCORD — New Hampshire was one of five states and one territory the Pew Charitable Trusts picked to analyze how they used federal pandemic aid funds and the risks to future budgets.

Like most states, New Hampshire used a vast majority of its federal funds for one-time projects and expenses, and to directly offset pandemic costs.

New Hampshire used little of the nearly $1 billion of its federal recovery plan money from the American Recovery Plan Act program for on-going operational expenses.

The organization looked at the future budget challenges states face due to the significant influx of the federal money, and noted there was no consensus for how states used the money, according to Rebecca Thiess, manager of the Fiscal Federalism Initiative.

The significant influx of federal money can produce revenue shortfalls when the money is exhausted, she said, as was seen at the end of the Great Recession.

Thiess said overall, the national average for the influx of federal money amounted to 14 percent of a state’s own resources. However, the amount of federal money flowing into New Hampshire was closer to 25 percent, according to information from the report, “Pandemic Aid: How States Safeguard Against Future Budget Challenges.”

The information was based on the reports states filed with the US Treasury on their use of the federal money in 2022. Thiess said the five states — New Hampshire, Florida, Illinois, Tennessee and Idaho — and one territory — American Samoa — produced reports with the greatest detail, had spent most of the money and provided geographic diversity.

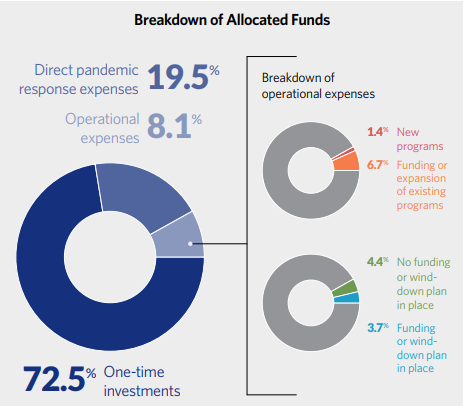

The organization broke down how the money was used into three categories, one-time expenses, direct pandemic expenses and on-going operational expenses.

The report suggests that all states should:

Prioritize immediate, acute needs;

Use funds for one-time investments;

Limit risks when spending on operational expense;

And assess the indirect impact of federal aid.

Thiess noted a number of states used large portions of their federal money to build up their unemployment funds for future savings for businesses, and Maine used $3.2 million of the federal aid to initiate a State Property Tax Deferral Program, which allows individuals at least 65 years old who meet disability requirements, to defer property tax payments until they sell their residence or die.

New Hampshire, for example, used $12 million for free COVID tests.

According to the report, about 35 percent of the federal funds were used by states for revenue replacement, although some states did not use the funds for that purpose.

“New Hampshire used revenue replacement on 22 programs, according to the state’s 2022 Recovery Plan. Those uses included the purchase of high-quality weatherproofing; portable, wireless internet connectivity devices, and school physical security assessments,” according to the report.

For New Hampshire, the state spent 72 percent of the $995 million in federal aid it received by July 2022.

One-time expenses accounted for 72.5 percent of the spending, direct pandemic response 19.5 percent and operational expenses 8.1 percent.

Of the operational expenses, 6.7 percent went to existing programs and 1.4 percent to new programs.

The state’s use of the federal funds by category were: public health, 30 percent; negative economic impact, 6 percent; public sector capacity, 3 percent: water, sewer and broadband infrastructure, 20 percent: revenue replacement, 38 percent, and administration, 2 percent.

The largest use of the revenue replacement funds — 10 percent — was for the InvestNH program to encourage housing development.

The public health spending included COVID-19 response, operational expenses for health care facilities, and purchasing a hospital, according to the report.

The operational spending was for workforce training and recruitment and support for social services and included some new hiring, according to the report.

“Looking ahead, New Hampshire recently enacted a two-year, $15 billion budget for fiscal 2024 and 2025. The budget phases out the interest and dividend tax by the end of 2024 while adding no additional taxes. The budget also includes a 10 percent pay increase for all state employees in fiscal 2024,” according to the report.

Thiess said it is up to the state to decide what they want to do with their taxes when this funding no longer exists, noting they had no specific information how that would impact the fiscal health of New Hampshire.

“We encourage policy-makers to look at the one-time nature (of the revenue) boom,” Thiess said, “and make decisions based on that.”

The only state of the five studied to spend the greatest percentage on something other than one-time expenses was Illinois, according to the report.

That state spent 63.5 percent of its federal pandemic aid on direct pandemic responses, 31.9 percent on operational expenses, and just 4.6 percent on one-time expenses.

Garry Rayno may be reached at garry.rayno@yahoo.com.