By GARRY RAYNO, InDepthNH.org

CONCORD — With little debate, the House Thursday approved a $137.4 million capital budget plan that utilized $105.7 million in federal funds.

Among the projects are the purchase of the old Granite State College Building on Hall Street in Concord for $7 million for the new home of the Department of Education, as well as the final installment of a three biennium building and renovation plan for the University System of New Hampshire, and several information technology systems for the Department of Health and Human Services.

The House also killed two bills dealing with the Education Freedom Account program that it had earlier approved and approved legalizing cannabis for recreational use, taxing it and using the money to offset education property taxes, the retirement system unfunded liability and for preventive and treatment programs.

The Capital Budget includes $17 million for the last installment for the university system construction program that includes Biological Sciences at UNH, Hyde Innovation Center at Plymouth State University and Elliot Student Services Center at Keene State College.

Also in the capital budget is $6.4 million for critical maintenance, IT infrastructure and space and equipment for a respiratory therapy program for the Community College System of New Hampshire.

Under the capital budget the Department of Transportation will receive almost $10 million for new sand and salt sheds, underground fuel tank replacement and crew quarters.

The Winnisquam Regional CTE Center renovations will have $7.6 million under the capital budget and the state Drinking Water Revolving Fund will receive $10.5 million.

Education Freedom Accounts

After barely passing the House in February, two bills reining in the Education Freedom Account program barely lost on the final votes Thursday.

House Bill 430 would require a student to attend a year of public school before becoming eligible for an EFA grant.

There are exceptions: if a sibling is in the program or for someone entering kindergarten or first grade.

The bill is intended to cut down on the number of students in private and religious schools or homeschool programs who were not attending public schools when the program began but receive grants to subsidize tuition payments to the private or religious schools or homeschool costs.

About three-quarters of the participants in the program were in private or religious schools or in homeschool programs before it started in 2021.

The program was sold as an alternative to public schools for children of low-to-moderate-income parents who would benefit from an alternative education environment.

Rep. Mary Hakken-Phillips, D-Hanover, said the bill is fair and fiscally prudent.

She said it would honor the original intent of the program while saving taxpayers money in a program that has cost far more than anticipated .

The choice some parents are making is instead of paying out of their pocket for tuition for their child is to have the state subsidize some of the cost, while local school districts are making the difficult choice of having to raise taxes or cut services because of the loss of state aid.

“Fairness and fiscal responsibility are two values we all embrace,” Hakken-Phillips said, “regardless of what side of the aisle we sit on.”

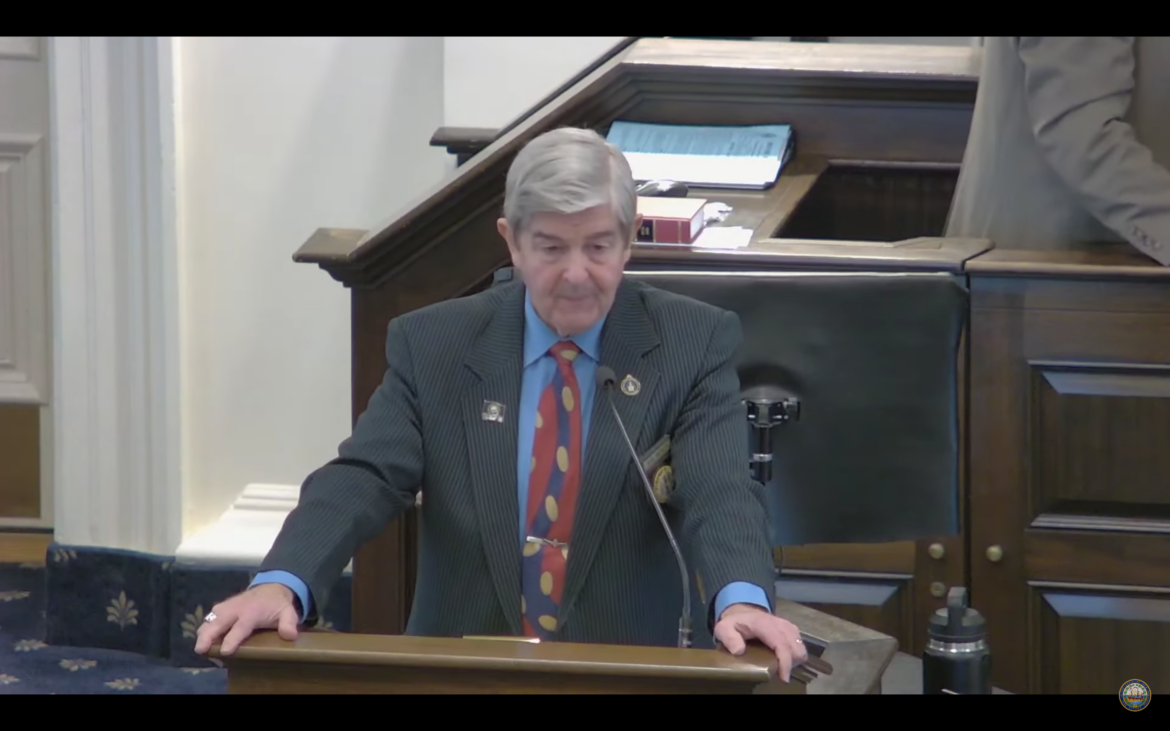

But House Finance Committee Chair Ken Weyler, R-Kingston, called the bill “an unnecessary roadblock to parental choice.”

Why require every student to go to a public school if a sibling has already gone there and the parents want an alternative education environment for their younger child, he asked.

He said people need to understand it costs about $20,000 to educate one child in a public school, but those participating in the EFA program are being educated for $5,000.

The bill was killed on a 194-192 vote.

House Bill 626 would have required the Department of Education to administer the EFA program instead of a contractor that receives 10 percent of the money.

The bill’s prime sponsor, Rep. David Luneau, D-Hopkinton, said if the department can be responsible for 165,000 students, it can serve the 3,200 in the EFA program at a much lower cost than the 10 percent the contractor retains.

Having the department run the program would make it more accountable to taxpayers, he noted.

But the bill was voted down on a 195-194 vote, with House Speaker Sherman Packard, casting the deciding vote.

Legalizing Pot

The House voted 272-109 to approve House Bill 639, which legalizes the recreational use of cannabis.

The House Ways and Means Committee changed the bill after it was initially approved by the House, including removing the excise tax and instead taxing it at the wholesale level at 12.5 percent.

The committee also changed the allocation of the state revenue so that 50 percent would be used to reduce the Statewide Education Property Tax, 30 percent would go to the state retirement system to pay down the unfunded liability and 20 percent to targeted treatment and prevention programs.

The committee reduced or eliminated the application and entrance fees and increased funding for program start up costs.

Tax revenue would be small for the first two years, supporters say, but then is expected to start increasing dramatically the third year and beyond.

The bill goes to the Senate, which has been a graveyard for marijuana legalization bills over the years.

If it does get through the Senate, Gov. Chris Sununu has said he will veto it.

Thursday’s session was crossover, which means all the House bills have to be sent to the Senate and vice versa.

Garry Rayno may be reached at garry.rayno@yahoo.com.