By PAULA TRACY, InDepthNH.org

CONCORD – Despite the efforts of Democrats to offer a “better budget alternative,” the majority of Republicans in the House of Representatives approved a $15.4 billion two-year budget that cuts many services and hikes fees on Thursday.

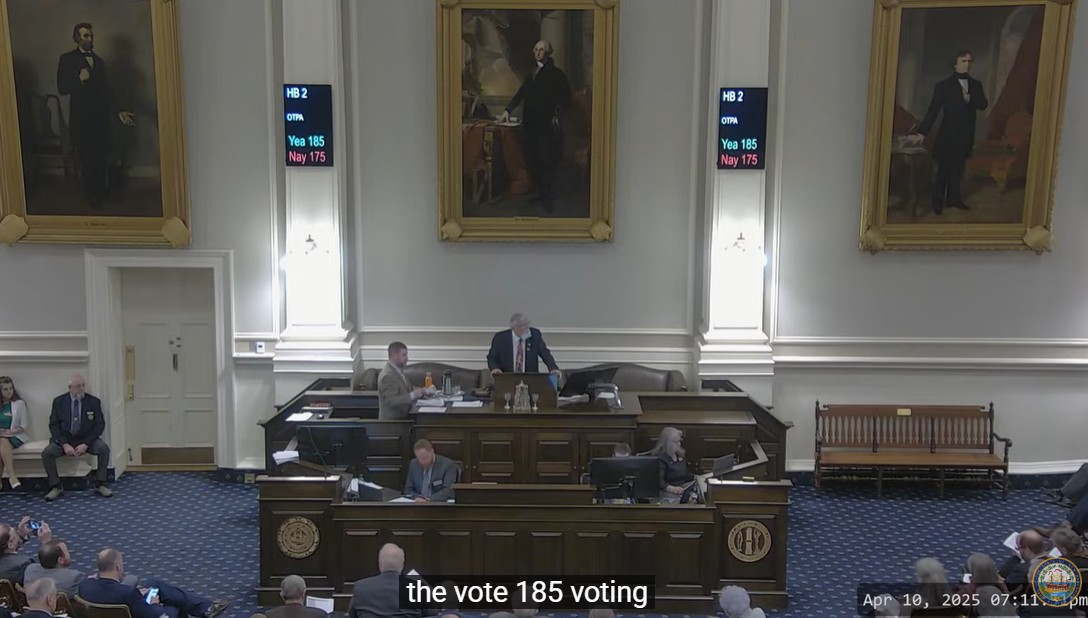

House Bill 2, enabling legislation for that budget which went through a series of amendments, passed.

House Minority Leader Rep. Alexis Simpson, D-Exeter, said the state budget is a reflection of the state’s values and this one harms the most vulnerable.

She said it increases costs for education and increases burdens on property taxes and increases money to the wealthy through the Education Freedom Accounts.

“We can and must do better,” she said.

The vote on House Bill 2 was 185-175.

House Majority Leader Rep. Jason Osborne, R-Auburn, said at 7:15 p.m. after most had come for a caucus at 9 a.m. “It’s been a fun day.”

“If I know that there is something in here that I want…and if I want a seat at the table” with the Senate which now gets to create its own budget, he said he would recommend they vote for it and “have a great evening.”

Exceptions to the House Finance recommendations for cuts included a vote to retain $14 million for state tourism promotion which is in the governor’s budget and to restore the Bureau of Land and Tax Appeals which were both contrary to the recommendation of the Republicans.

It also stripped out of the budget the controversial bill which relates to school district tax caps, House Bill 675, which narrowly passed as a bill several weeks ago.

This is only the second in four steps of the state budget process.

The first was Republican Gov. Kelly Ayotte’s budget in February. The Senate now gets to craft its own budget and then there will be a committee of conference and then sent to Ayotte for her signature or veto, likely in late May.

Ayotte said Wednesday she hopes the Senate version will be closer in line with her proposal. She is working closely with the Senate and said they’re likely to look at higher projected revenues.

Her $16 billion proposal enjoyed better revenue numbers in February than the House Finance Committee.

WHAT THE HOUSE BILL DOES:

It cuts more than 150 job positions in government many in the prison, expands Education Freedom Accounts for no income limits in the second year, reduces provider rates for Medicaid, abolishes the Office of Child Advocate and the State Council on the Arts which helps community arts, reduces funding to the University System further than the governor’s recommendation by $50 million, eliminates a higher education grant program, abolishes the commission on aging, increases fees on everything from environmental permits to motor vehicles and asks those who receive Medicaid to pay a 5 percent co-pay along with many state department back of the budget requests but helps the Group II retirement of first responders and some help for the victims of abuse at the former Youth Development Center.

Stripped from the budget, however, in Thursday’s vote was House Bill 675 the Property Tax Relief Act to place a cap on local school district election budgets.

It passed the House and is on to the Senate but it does not now have the protection of being part of the budget. The vote to eliminate it was 206-165.

The Democrat’s “Better Budget” amendment went down.

State Rep. Mary Jane Wallner, D-Concord, said it would provide a budget that better suits the needs of the state and restores vital services, invests in communities and provides for economic benefit and is responsible, grounded in common sense. It would have been funded by raising money from slot machine gambling and eliminating the increased costs for expanding the Education Freedom Accounts

Rep. Jess Edwards, R-Auburn, said the amendment was hidden from the Finance Committee and that they had transparency in their process, and Democrats should have done it “right.”

It failed on roll call on a vote of 166-204.

And then came the parade of amendments to House Bill 2.

Efforts, mostly on the Democratic side to remove aspects of the House Finance recommended budget failed. The budget is seen as a safe harbor for Republicans if the Senate decides to vote against bills passed by the House because it is harder to remove it in some cases than killing a bill.

SCHOOL TAX CAP AMENDMENT

State Rep. Robert Lynn, R-Windham offered an amendment related to the present version of the Property Tax Relief Act under HB 675 which was included in HB 2 saying it goes too far. But it was defeated on a lopsided vote of 28-341.

Rep. Dan McGuire, R-Epsom, opposed Lynn’s amendment though he said it pained him. Property tax is heavy on the cost of the schools and it is “out of this world” with over $27,000 per pupil in his town.

“This amendment gives them an inflation adjustment…every year even though the school population is in decline,” he said.

“It should be a CPI together with population adjustment. CPI only is actually increasing the cost per pupil and making the property tax situation worse,” he said.

Another amendment related to the school tax cap bill was to eliminate it.

Rep. Ralph Boehm, R-Litchfield, said the amendment removes HB 679 from the budget bill.

He said the measure would be removing local control from districts which already have the right to do this “but this would force school districts to do this.

“What next, telling a town how to zone?”

He said if it wasn’t removed he could not support final passage of the budget.

But McGuire disagreed. He said property taxes are high and schools are the reason.

“This piece of legislation is a way to give our local property taxpayers a little bit of relief and a little control, a pause in the raising of property taxes that they well deserve,” he said.

FAMILY PLANNING FUNDING

House Minority Leader Rep. Alexis Simpson, D-Exeter, offered an amendment to fully fund family planning which is eliminated in the Republican version of the House Finance Committee budget recommendation but is included in the governor’s budget.

The vote however, failed on a vote of 174-196.

Rep. Edwards said in the Finance Committee division he worked on, they articulated priorities for programs with patients in a bed where state employees care for them like the Glencliff Home. The priorities were to care for them first but “at some point you are just out of money.”

He said if he could have looked closer in some northern areas of the state where there are little to no alternatives for family planning. But his recommendation was to pass the budget, get it over to the Senate and make a case for locations where there are no other alternatives.

These are adults that we are talking about, he said that use the family planning services.

But some said they are adults in rural areas with no alternatives and nowhere else to go.

Rep. Janet Lucas, D-Campton, said patients served in the family planning program cannot afford services anywhere else and if the state does not fund it, health care centers could close entirely leaving people without access to health care.

Edwards said family planning is funded in the governor’s budget but this year he said he knows there is the opportunity for donors to help. He suggested those who are philanthropic to step up.

OFFICE OF THE CHILD ADVOCATE

An effort to restore funding for the Office of the Child Advocate, which is not in the House Finance Committee’s recommendation, failed on a vote of 177-190.

Advocates said while headlines and tragedies about children’s deaths put the state in a bad light, the office was able to save two children who had been placed out of state and has been invaluable in addressing legislation.

The governor has supported the office in her budget.

But McGuire said this is a duplicative function with the state Department for Children, Youth and Families. If that department is not run well, it does not need an ombudsman or someone overseeing it like the office, he argued. His view prevailed.

TOURISM PROMOTION

In a rare exception, the House Finance Committee recommended cuts in the governor’s state tourism promotion budget of $14 million were not agreed to.

The House voted to restore the governor’s funding level in a vote of 198-169.

Hampton state Rep. Nicholas Bridle noted that small businesses can’t afford a billboard in New York City but the state has a stake in the game in terms of rooms and meals revenue. He said states which have removed such funding saw a loss of rooms and meals revenue and paid the price.

He said a healthy tourism industry helps pay the bills for a lot of other aspects of the state’s budget and economy and was perhaps persuasive.

The governor has also noted there is a strong return on investment which helps the bottom line.

But Rep. Joe Sweeney, R-Salem, said this is not something the Granite State needs to answer in the budget. Trade associations can fund their own advertising for the next two years, he argued.

BUREAU OF LAND AND TAX APPEAL

In another reversal, the House Finance Committee also recommended the elimination of the Bureau of Land and Tax Appeal as a tax savings matter, but opponents said this would cost poor and elderly people more money to instead go to court. In the end they won.

On one of the closest votes of the day, the House voted to retain the program on a vote of 183-180.

McGuire said the problem is that the board is “super expensive.” With 58 decisions he said they spent $1.2 million a year, leading to over $20,000 a decision on average.

The cost of the Superior Court averages $1,500 a case.

SCHOOL MEALS

An effort to retain the pilot Medicaid Direct Certification Program which helps the state identify who is eligible for free and reduced lunches came close to being kept in the House budget but missed the mark by one vote.

The vote to restore the program was 181-182.

State Rep. Hope Damon, D-Sunapee advocated for feeding these children as economically smart. There is no impact funding on adequacy she noted and said as many as 10,500 children are impacted.

COUNCIL ON THE ARTS FUNDING

The House Finance Committee recommended the state eliminate all funding for arts which is $1.7 million a year under the governor’s proposal.

But the proposal to restore that funding failed on a vote of 177-185.

Rep. Matt Wilhelm, D-Manchester, said the creative arts economy makes significant contributions to the state. The vote would make the state the first in the nation to not support the arts.

Rep. Sweeney said $1 million to subsidize it is not prudent to prop up “propaganda pieces,” and he urged lawmakers to vote it down.