By GARRY RAYNO, InDepthNH.org

CONCORD — A new study by the New Hampshire Fiscal Policy Institute finds business tax rate reductions have cost the state between $795 million and $1.17 billion in forgone revenue since 2015 without the often promised bump in revenue due to increased economic activity.

Instead New Hampshire’s business tax growth lagged the national average, the New England average and both Maine and Vermont over the period from 2015 to 2024.

Business taxes are the single biggest tax source of money for state government and have been declining since last fiscal year.

With the New Hampshire House finalizing its proposed two-year budget package this week, the foregone revenue from the rate reductions could have prevented some of the draconian reductions proposed such as the reduction in state aid to the University System of New Hampshire, eliminating the NH Council for the Arts, major reductions to the Department of Corrections and charging low-income citizens on Medicaid premiums and copays for their health care.

The additional money could also be used to fund education, health care, or infrastructure, or provided tax reductions directly aimed at benefiting individuals with low and moderate incomes, according to the study done by study leader Phil Sletten, Research Director at NHFPI.

The report notes that a federal study found food assistance programs for the poor like Supplemental Nutrition Assistance generated $1.61 for every dollar invested, and federal aid to state and local government generates $1.34 for every dollar invested, while rate reductions produce only 34 cents in gross domestic product for every dollar of tax cuts.

The NHFPI report, Business Tax Rate Reductions Led to Between $795 Million and $1.17 Billion in Forgone Revenue for Public Services Since 2015, uses newly-available data to update and extend the time period of prior NHFPI estimates published in 2023 and show the fiscal impact of reductions to New Hampshire’s two primary business taxes: the Business Profits Tax and the Business Enterprise Tax.

“The research clearly shows that business tax rate reductions did not generate enough economic activity to offset the revenue shortfalls they generated,” said Sletten. “New Hampshire’s business tax revenue growth lagged behind Maine and Vermont, as well as average growth nationwide, indicating New Hampshire’s tax policy changes did not cause the state’s increase in revenue.”

While total business tax revenues rose over the last decade, the study builds on the 2023 analysis and finds no evidence that those increases were driven by the rate reductions. Instead, the study found national trends like the surge in corporate profits following the COVID-19 pandemic, appear to be the key drivers.

The national trends also benefited other states that did not lower their business tax rates.

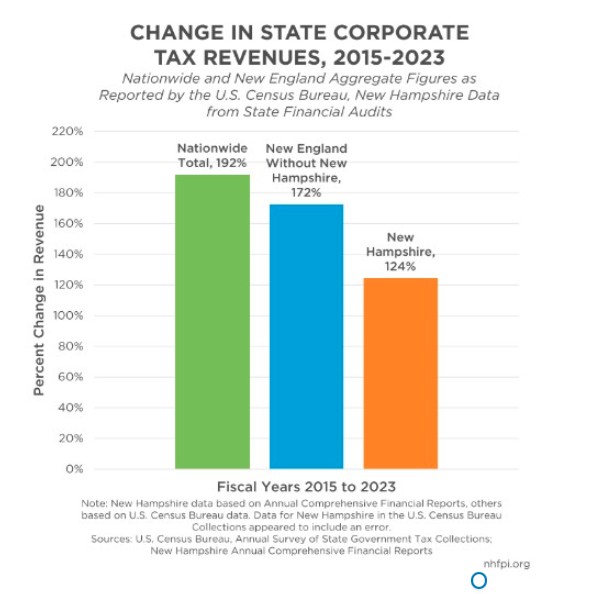

New Hampshire’s business tax collection rose 124 percent from 2015 to 2023, which is well below the 166 percent increase in Vermont and the 167 percent increase in Maine during the same period, where the top corporate rates did not change.

Nationally, the growth in business taxes was 192 percent during the same period, and 172 percent in the New England states not including New Hampshire.

“Budget decisions involve trade offs, and policymakers need good information to understand those tradeoffs,” Sletten said. “This research provides insights into which policies are most effective at strengthening our economy and improving the lives of Granite Staters.”

While combined BPT and BET revenues increased during this period, reviews of existing research, separate analyses of economic changes and tax revenue trends in New Hampshire, and from other states around the country indicate New Hampshire’s business tax rate reductions lowered revenue relative to the amounts the state would have collected if the rates had remained at their 2015 levels, according to the report.

The study found six key reasons for finding business revenues were foregone rather than increased through cross-border investment.

According to Sletten, BET revenue declined relative to the tax base after each rate cut.

Between 2008 and 2015 BET revenues tracked private sector wages, which grew at 20 percent while revenues grew 23 percent during the same period.

But for the period between 2015 and 2021 private sector pay increased 43 percent, but BET revenue only increased 12 percent, and for the period 2015 to 2022, wages increased 49 percent and BET revenue increased 4 percent.

Sletten notes that the BPT was responsible for 97.7 percent of the business tax growth during the period.

He also notes there is no statistical relationship between BPT rate cuts and job growth nor between cuts and gross state product growth.

For the period between 2001-2024, New Hampshire lagged behind the nation, the region and Massachusetts in job growth, the report notes, and that the state also lagged behind personal income per capita for the nation, region and Maine and Vermont.

The study also found that national corporate profits have surged and high profit companies pay most of the BPT.

Sletten found that “a relatively small number of large business tax filers pay most of the revenue collected.”

For the 2022 tax year, 2,554 business tax filers or .2 percent, paid $326.4 million or 40.3 percent of the total.

The study also found that 60 percent of the revenue collected under the BPT were “water’s edge” filers.

The study did find the number of businesses filing to pay business taxes increased from 2015 to 2021, but not enough to account for the increase in business tax revenue during the period.

And the study found from research from other states and nationally does not provide evidence that increased economic activity from business tax reductions offset revenue losses.

The National Tax Journal found “major recent studies reach almost every conceivable finding: tax cuts raise, reduce, don’t affect or have no clear effect on growth.”

The report concludes “business tax rate reductions enacted in New Hampshire since 2015 have resulted in significant losses of state revenue available for public services.”

Rate reductions are not determinant for the direction of the state’s economy, Sletten writes, but the BPT and BET are key revenue sources for funding public services.

“As policymakers are considering the next state budget, balanced budget requirements result in policy outcome tradeoffs for each dollar of revenue raised as well as for the deployment of dollars spent on services,” Sletten writes. “Policymakers aiming to use state fiscal policy for the benefit of Granite Staters and the local economy may seek to consider reductions in taxes that directly affect New Hampshire residents with low and moderate incomes, or to preserve and bolster services that support Granite State individuals, families and the workforce.”

The study may be found at: https://nhfpi.org/resource/business-tax-rate-Reductions-Led-to-Between-795-Million-and-1.17-Billion-in-Forgone-Revenue-for-Public-Services-Since-2015/

Garry Rayno may be reached at garry.rayno@yahoo.com.