By GARRY RAYNO, InDepthNH.org

CONCORD — New Hampshire is not alone in facing budget cuts, increased taxes or tapping its rainy day fund in the next few years to balance its financial books.

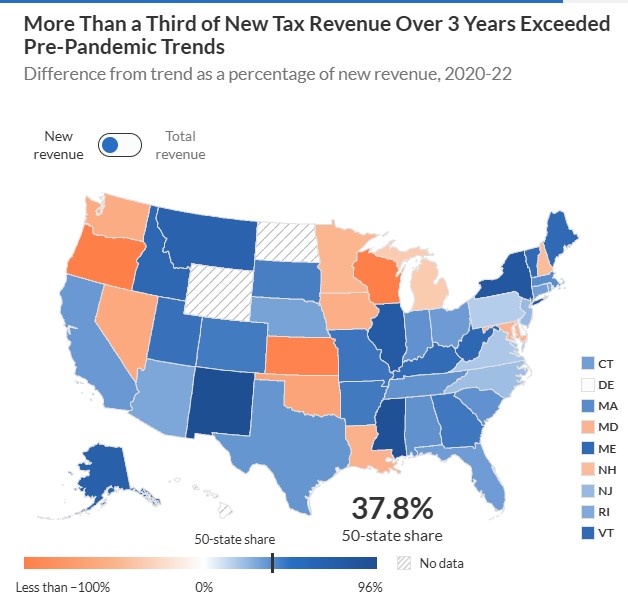

The state used billions of dollars of federal money to fuel its economy creating revenue surpluses in the hundreds of millions of dollars since the pandemic and responded with tax cuts and increased spending that now is unsustainable as revenues have trended down in the last two fiscal years.

Other states did much the same, taking care of long standing issues and reducing taxes so that now budget stresses are widespread, according to a new report done by the Pew Charitable Trusts.

The first of a five-part series on five fiscal debates to watch in states, focuses on the budget shortfalls facing many states from Maine to California, and from Florida to Washington, either this year or out into the future, according to the report.

“(Many state) officials who were spared fiscal challenges over the last four years will have to begin the more difficult work in 2025 legislative sessions of setting priorities, scrutinizing spending, and seeking new sources of revenue,” writes Josh Goodman, Pew Senior Officer for State Fiscal Health. “Immediate budget challenges remain far from universal—in many places, the strong economy has helped revenue collections remain resilient—but even states that are doing well in the short term may need to prepare for tighter years ahead.”

States produced record highs in state revenues in fiscal 2021 and 2022 and with residual federal pandemic money helped lawmakers in New Hampshire and around the country pass budgets for fiscal 2023 and 2024 with little commotion, but now see their revenues shrinking to the point of creating deficits for the 2025 fiscal year.

The report notes many states are like Colorado which is facing a revenue gap of $750 million for fiscal 2026 just months after approving additional spending and tax cuts.

Maine faces a $637 million structural deficit going into its next biennium, two years after estimates showed a structural surplus, and Washington’s Office of Financial Management director, Pat Sullivan, estimates “the state’s shortfall for the next two, two-year budget cycles at $10 billion to $12 billion,” according to the report.

The concerning part about the budget deficits is not their size, but where they are occurring in the economic cycle, Goodman said.

“With job gains steady, unemployment low, and the national economy still growing, states do not face shortfalls because of a temporary downturn,” he writes. “Rather, in many states, forecasts show structural deficits, with ongoing revenue at risk of chronically falling short of ongoing spending after recent tax cuts and spending increases.”

Even states with balanced budgets this year will need to be aware of future problems as overall revenues shrink from their record highs, he noted.

Most states have reserves from surpluses and left over federal money that could cover shortfalls in the short term, he said, but using that money just postpones more difficult decisions in the future.

New Hampshire’s Rainy Day Fund contains more than $250 million and with the revenue surplus was estimated to be $111 million for the 2024 fiscal year the state has a substantial cushion.

Goodman used Iowa as an example where cutting taxes is expected to reduce that state’s revenue by about $1 billion for fiscal 2026, which is not enough to cover current spending.

Because the state’s budget writers believe the tax cut will spur economic activity, the state plans to use reserves in the short term to cover any deficit expecting greater revenue returns in the future, he writes.

Other states anticipated using some of the reserves for long-term priorities such as “improvements to the energy grid, water infrastructure, and broadband access. Other priorities include private school vouchers and expanded local property tax cuts,” Goodman writes.

The report also notes most states are moving away from tax cuts as revenue shrinks, although Mississippi and Montana plan to cut income tax rates in the coming sessions.

Other states are pairing any tax reduction with other revenue raising measures to offset any tax reduction, the report notes.

Other states eye spending reductions to offset the revenue shortfalls in the coming years, especially the states’ most expensive areas, Kindergarten to 12 grade education and Medicaid, according to the report.

Goodman noted Colorado is experiencing whiplash as just last year the state for the first time in 14 years provided the education funding envisioned by the state constitution, but now faces a deficit, largely driven by Medicaid expenses.

Illinois faces a number of challenges such as a $730 million shortfall for the Chicago-area transit system, public schools facing a revenue cliff with the end of federal pandemic help, and trying to make up for decades of underfunding its pension plan.

“Taken as a whole, state leaders will need to square their desire to maintain recent tax cuts and spending increases with more challenging fiscal realities,” Goodman writes. “To see how these debates might play out in 2025, one place to look is the smaller group of states. . . that faced budget shortfalls in 2024.”

Those states did not back away from big-ticket policies they adopted in the past few years, but did use a combination of actions to address their shortfalls.

Most did not empty their reserve accounts but used some funds, cut spending and raised some revenues, according to the report.

“States with shortfalls this year may employ a similar playbook” Goodman writes. “If they do, one big question will be whether these targeted actions are sufficient to get their budgets on a sustainable course or whether policymakers will simply be setting themselves up for a repeat of the problems in 2026.”

The other four parts of the series will deal with transportation funding and electrical vehicles, harvesting artificial intelligence, public school funding and affordable housing all issue New Hampshire has grappled with over the years and continues to seek solutions.

Garry Rayno may be reached at garry.rayno@yahoo.com.