By NANCY WEST, InDepthNH.org

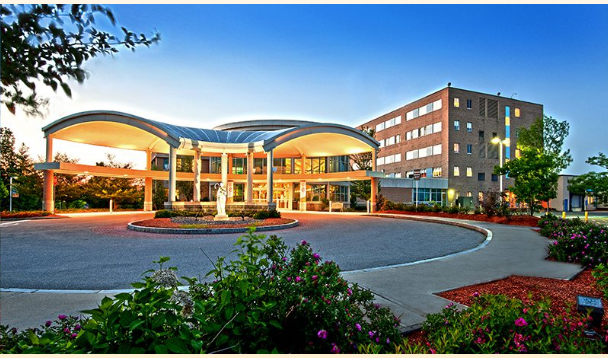

Insurance Commissioner DJ Bettencourt said Friday that Anthem and Saint Joseph Hospital have agreed to meet with him Tuesday to hopefully help resolve their two-year contract dispute that caused up to 10,000 people suddenly being told that as of Jan. 1, 2025, they are no longer part of Anthem’s insurance network.

Bettencourt said the department has no legal authority to force Anthem and the hospital to come to terms, but said he invited both sides to a meeting to offer help from the department if needed.

He said he has spoken separately with representatives of both Anthem, the state’s largest health insurance carrier, and the hospital.

“Both sides share my understanding of the importance of coming to agreement and the urgency of coming to agreement,” Bettencourt said, adding it is a unique situation.

He reiterated there are short-term protections for patients by state and federal law.

“Both parties understand that failure to come (to reach agreement is) causing a great deal of upheaval for a lot of people,” Bettencourt said. “I’m an eternal optimist and based off what I’ve heard from both parties of their understanding of the importance gives me confidence they will ultimately come to agreement.”

When asked what the department has to offer, Bettencourt said it can offer resources such as the work of two data scientists who can help crunch numbers and an all-claims database for information queries should that be needed.

He said he doesn’t know what the remaining sticking points are preventing an agreement.

“We don’t have legal authority to mediate or force an agreement. What we are doing is bringing the parties together to make them aware of what we can provide in the promotion of coming to an agreement,” Bettencourt said.

It’s unique in that the people and businesses affected have made their insurance decisions.

“The timing is really problematic,” he said in that insurance decisions are usually made in the fall for the coming year. Those affected would have to wait an entire calendar year to change if the contract dispute isn’t resolved, he said.

Bettencourt said he is cautiously optimistic the new contract negotiations will be in agreement by March when the legal protections run out.

Anthem Medicare Advantage plans will not be affected.

The ongoing negotiations aim to establish a new contractual agreement to reinstate the Nashua-based hospital in the network. The hospital issued a letter to patients, dated December 30th, 2024, available at https://stjosephhospital.com/patients-visitors/anthem-updates.

New Hampshire law states that, “Within 5 business days of the contract termination, the health carrier shall provide written notice to affected covered persons explaining their continued access rights.”

The requirement of the carriers to provide notice to consumers is enforced by the NHID.

“This disruption comes at a critical time when individuals have already made their health plan choices for 2025,” said Bettencourt. “Patients—including pregnant mothers, dialysis patients, and those undergoing cancer treatment—face unnecessary upheaval in their healthcare continuity due to this dispute.”

Anthem spokesman Stephanie DuBois said in an email Friday: “We are continuing to seek an agreement with St. Joseph Hospital that keeps them in our network for years to come. While St. Joseph’s has notified us that they are not interested in negotiating further at this time, Anthem remains firmly committed to reaching an agreement that provides our members with access to high-quality, affordable healthcare with St. Joseph Hospital. Members with questions may visit anthem.com/stjosephnh or call Member Services at the number on their Anthem ID card for assistance.”

Saint Joseph Hospital didn’t immediately respond to a request for comment Friday.

Anthem is required by state law to continue paying claims at in-network rates for 60 days following notification, according to an Insurance Department news release.

Additionally, federal laws ensure coverage for “continuing care patients,” which includes individuals with chronic illnesses and pregnant people, for at least 90 days post-notification or until they are no longer considered “continuing care” patients with the terminated facility.

Consumers with questions or concerns are encouraged to contact the NHID Consumer Services Division at 603-271-2261 or visit https://insurance.nh.gov.