By GARRY RAYNO, InDepthNH.org

CONCORD — The House wants Congress to make an official declaration of war before the New Hampshire National Guard is deployed in a combat zone overseas.

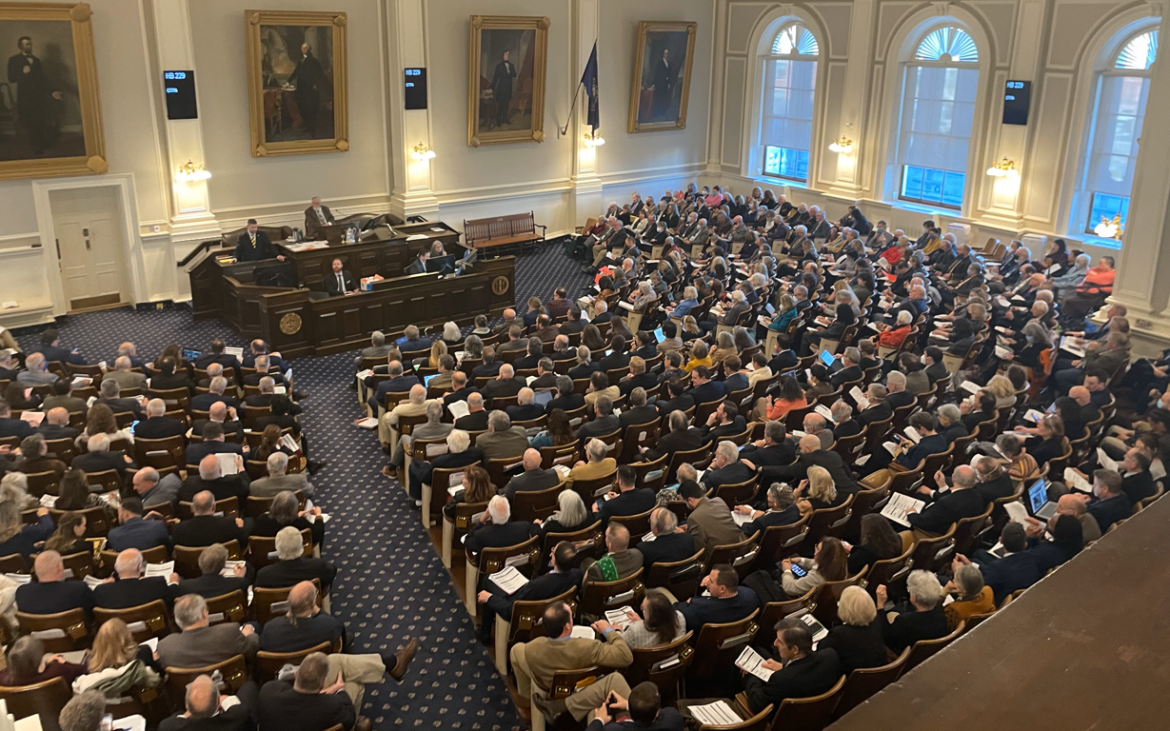

Thursday the House voted 187-182 for House Bill 229 which is similar to other bills being considered in other states.

The bill would require Congress to meet its constitutional obligation to declare war and not turn the duty over to the executive branch before putting New Hampshire guard in danger, supporters said.

The deployments covered under the bill would include both active duty combat units and support units.

The bill does not affect guard activity within New Hampshire or other states or for training missions outside the state.

Rep. Matthew Santonastaso, R-Jaffrey, said only Congress has the constitutional authority to declare war, but after the 9/11 terrorist attacks on New York City and Washington D.C. Congress passed the Authorization of the Use of Military Force, which presidents have used to go to war with other nations.

The act allows the president to use all the necessary and appropriate force against another nation that has attacked this country or its allies.

Santonastaso said the act has resulted in unchecked executive power and allows Congress to sidestep its responsibilities and accountability.

Before making a decision that impacts men and women of New Hampshire, Congress should do its job and make a formal declaration of war, he said.

But Rep. Stephen Shurtleff, D-Penacook, and a Vietnam veteran, said he does not support the bill and noted the State Veterans’ Advisory Council voted 20-0 to oppose the bill as well.

“This is not a good bill, it is not good for the National Guard, it is not good for New Hampshire, it is not good for our country and it is not good for our people on active duty,” Shurtleff said, noting the state receives up to $2 billion annually from the Department of Defense mostly for planes for the Air National Guard and for the helicopters often used to rescue people.

All of that could be put in jeopardy by the bill, he said.

The military needs to be able to act immediately if the country’s defense is at risk, Shurtleff said.

He noted when he served in Vietnam, national guard units were nearby and they acted as one unified force.

Rep. Tom Mannion, R-Pelham, who served two deployments in support of Operation Iraqi Freedom, said 38 states have similar bills making their way through the legislative process.

He called it nonsense that the federal government would withhold money for the state’s guard because the legislature passed the bill, noting it would be political suicide for a politician to do that.

Mannion said since the authorization of force was passed the National Guard has been deployed in 22 countries in never ending wars, while the bill would stop the “uniparty war machine.”

“It’s in our hands now to protect the men and women in our state,” Mannion said, “and defend the guard.”

Worldwide Unitary Tax

The House voted down House Bill 121, which supporters said would provide about $177 million in new business tax revenue annually without raising taxes.

The bill’s prime sponsor, Rep. Thomas Schamberg, D-Wilmot, said the bill would level the playing field for New Hampshire businesses who are disadvantaged under the current “water’s edge” provision allowing large national and multinational corporation to skip out of their true tax liability, while New Hampshire companies have to pay their full liability.

The state at one time used the worldwide combined unitary tax to tax foreign companies along with a number of other states, but were pressured by England and in turn the Reagan administration to drop the provision for the water’s edge method, which looks at just what business a company does in a state.

But Schamberg said that allows the foreign corporations to move money to countries with lower tax rates so that they do not pay their full share, shifting the tax burden to New Hampshire companies.

“This is a moral and legal decision each of us must make in

voting for the (inexpedient to legislate motion),” Schamberg said. “That is a vote to punish New Hampshire businesses” while protecting multinational corporations.

Rep. Nicole Leapley, D-Manchester, compared a local coffee company to Starbucks, both charging the same for a Latte. The local company pays the rooms and meals tax but Starbucks can move the money to a foreign country with a lower tax rate and may be able to take a loss on the sale, she noted, leaving more money for Starbucks to pay its employees more or lowering prices making it difficult for the local company to compete.

“We cannot continue to let these multinationals play three-card monte with New Hampshire tax money,” Leapley said. “We have to stop these multinationals from stealing our lunch money.”

But Rep. Walter Spilsbury, R-Charlestown, said it is not as simple as supporters would have you believe.

New Hampshire, like other states, never enforced its worldwide unitary tax, he said, and every state abandoned it under pressure from foreign countries, the federal government and a rash of lawsuits.

“Why go back to something every state abandoned,” Spilsbury said. “No state applies worldwide combined reporting.”

He noted it would be extremely cumbersome for businesses and for the Department of Revenue Administration to go back to that system.

“If you were told this would level the playing field,” Spilsbury said, “you are getting a distorted presentation.”

If the bill passes the state will spend years getting out of a quagmire, he said.

Charitable Gaming

The House approved Senate Bill 121 which would eliminate rent for charitable organizations for using the gaming halls. The issue of rent has come up after regulators moved to block former Sen. Andy Sanborn, R-Bedford, from renewing his casino operators license for the Concord Casino due to alleged misuse of federal COVID money.

The bill also removes the sunset date for a moratorium on new locations for historic horse racing games, much like slot machines, but allows current applications to continue.

The bill will go back to the Senate because of the House changes.

Medicaid Expansion

Republicans defeated an attempt by Democrats to do away with the seven-year extension for the state’s Medicaid expansion program.

The Senate and House Democrats had wanted the program to be permanent last year during the budget work, but eventually agreed on a compromise of seven years.

Democrats argued the permanent extension has the backing of the business community, health care providers and participants in the eight-year-old program.

But Republicans argued the issue was settled in the bipartisan budget agreement and a program that size needs to be evaluated from time to time.

Senate Bill 263 was killed on a 191-183 vote.

OSHA for Public Workers

The House also killed House bill 232, which would have brought public employees under the federal protection program or OSHA, which covers private workers.

Public worker protections are under state Department of Labor guidelines and not as extensive as the federal program.

Even opponents of the bill admitted the state’s guidelines need to be updated as they have not been changed in 10 years, but did not believe public workers would need to be under OSHA regulations.

Non-public Sessions

The House also killed House Bill 652, which would have required someone the subject of a non-public session by a public body be informed and allowed to attend the session if a decision is being made or there could be a referral to another venue such as criminal investigation.

Supporters said such instances are going on in several communities that are tarnishing people’s reputation without a pathway to answer the accusations.

Opponents of the bill said, as written, it creates too many problems for public officials and may interfere with investigations.

No Guns for Felons

The House soundly defeated a bill that would have allowed a convicted felon to have his or her right to own a gun returned after serving their sentence and making restoration.

Sponsored by Rep. Jason Gerhard, R-Northfield, who served time in a federal prison for helping Ed and Elaine Brown of Plainfield in their standoffs with federal agents over failure to pay taxes on their earnings.

The vote to kill the bill was 297-63.

The House Thursday finished work on about 200 bills left over from the 2023 session and will begin public hearings next week on the nearly 1,000 bills they have to process this session.

Garry Rayno may be reached at garry.rayno@yahoo.com.