By Phil Sletten, Research Director NH Fiscal Policy Institute

The New Hampshire Senate Finance Committee’s version of the State Budget proposes retaining most of the key provisions of the House’s version of the State budget, with some changes made to food assistance for school children, Medicaid Expansion, funding for local public education, and contribution to the New Hampshire Retirement System. The Senate Finance Committee voted to shift certain appropriations off-budget or into the current State Fiscal Year, reducing the size of the appropriations recorded in the drafted operating budget while keeping funding for services at similar levels in most areas.

Budget Figures Smaller, But Total Services Authorized Similar

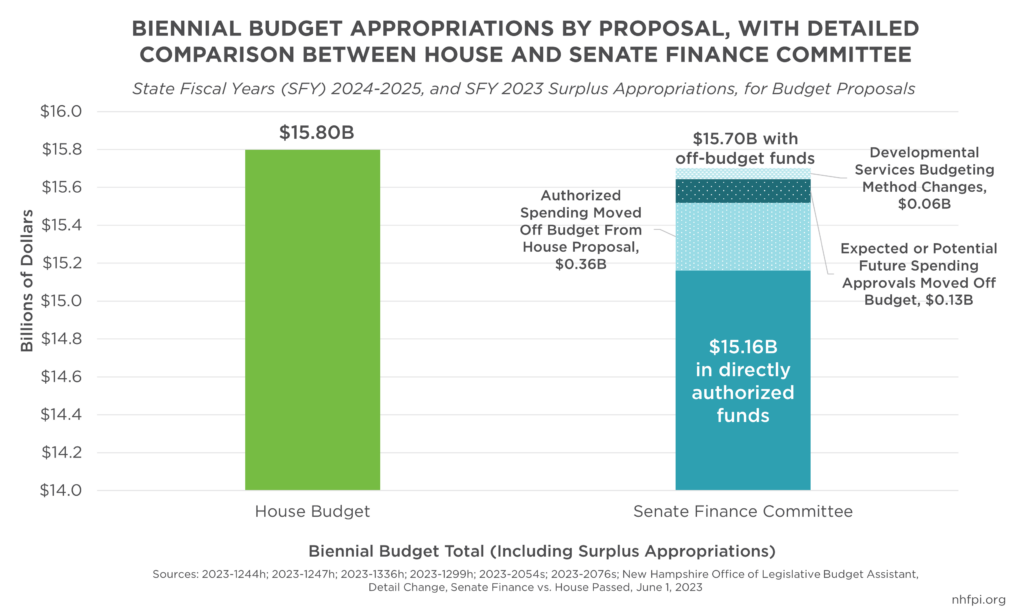

The Senate Finance Committee’s version of the State Budget directly appropriates $15.16 billion, including $335.8 million in General and Education Trust Funds in the State Fiscal Year 2023, before the next budget begins. While the operations funded by these $335.8 million in appropriations would largely occur during the next budget biennium, the funds come from the current State Budget’s revenue surplus and are technically appropriated in the current State Fiscal Year, but are still authorized as part of the Senate Finance Committee’s proposed State Budget legislation. The Senate Finance Committee proposed funding $112.9 million more in appropriations in this manner than the House did in its State Budget proposal. In budgeted appropriations, the Senate Finance Committee version of the State Budget is approximately $637.3 million (4.0 percent) smaller than the House’s State Budget proposal.

Much of that decline is due to the Senate Finance Committee proposing to move funds that could be authorized separately from the State Budget’s accounting of expenditures. Relative to the House’s State Budget, the Senate Finance Committee proposed keeping $358.1 million in services fully funded, but shifted them outside of the State Budget; these shifted appropriations include municipal aid generated by the Meals and Rentals Tax, the Renewable Energy Fund and the Greenhouse Energy Efficiency Fund, and anticipated federal funds for Medicaid information technology infrastructure that was included in the House’s version of the State Budget. The Senate Finance Committee also proposed shifting $125.5 million in funds to be accepted at a later date through either the Joint Legislative Fiscal Committee or the Executive Council, rather than being authorized directly by the State Budget as the House had proposed and included in its budget. These funds shifted off-budget include a significant number of water-related environmental grants expected to be provided through the federal Infrastructure Investments and Jobs Act. Changes in accounting decisions related to carrying forward funds for developmental services also reduced budgeted appropriations by $57.2 million without changing services. Including all these funds, which the House incorporated into its $15.80 billion version of the State Budget, the Senate Finance Committee’s proposal totals $15.70 billion, or only $96.5 million (0.6 percent) less than the House’s version of the State Budget.

Key Funding Reductions

While many appropriations were authorized by the Senate Finance Committee but budgeted differently, the Senate Finance Committee did reduce funding in some key areas relative to the House.

Food Security For Children In School

The Senate Finance Committee proposed substantially reducing food assistance services to children in school relative to the House budget.

The House proposed granting access to free meals at school to all children with household incomes under 300 percent ($74,580 for a three-person family) of the federal poverty level, rather than the current thresholds of 185 percent ($45,991 for a three-person family) for reduced price meals and 130 percent for free meals. This proposal would not have impacted State funding for local public education through the State’s education funding formula, but would have enhanced access to free meals for more New Hampshire students.

The House also proposed seeking to directly identify students with incomes low enough to be eligible for free and reduced-price school meals based on income information their households had already supplied to the State’s Medicaid program. This step would streamline the process for enrollment and identify more students with low incomes who are already eligible for free and reduced price meals but are not participating in the program. Medicaid enrollment among children with low incomes is substantially higher than free and reduced-price school meal enrollment, and parents or guardians would not have to complete an additional set of paperwork to make their student receive this benefit. This Medicaid direct certification program would require permission from the federal government, and would increase funding for local public schools through the education funding formula, which enhances funding for schools based on the number of free and reduced-price meal eligible students.

The Senate Finance Committee voted to remove both these proposals, and would instead establish a commission to study the impact of Medicaid direct certification and enhanced Food Stamp Program enrollment on free and reduced-price school meal eligibility. The Committee also eliminated $30 million in Education Trust Fund appropriations made by the House to support any unanticipated increase in free and reduced-price school meal enrollment.

Retirement Contribution Changes

The Committee proposed eliminating the House’s $50 million contribution to the New Hampshire Retirement System’s unfunded liability, which totaled nearly $5.7 billion in June 2022. The Committee also voted to eliminate the $25 million per year, or $50 million during the budget biennium, appropriation to provide enhanced retirement contributions and support subsequent benefits policy changes for approximately 1,824 State and local fire and police employees who were not vested into the New Hampshire Retirement System prior to 2012.

The Senate Finance Committee also proposed adjusting certain annuity retirement benefits to pivot around the age of full retirement for federal Social Security, rather than around the currently-established age of 65 years. The Committee also reduced the appropriation for a one-time payment for certain State retirees from $9 million to $7 million while altering the structure to include more retirees.

Medicaid Enrollment Projections

The Senate Finance Committee’s version of the State Budget also reduces Medicaid funding appropriated to managed care organizations by about $88.2 million in total federal and General Funds. This reduction was due to the New Hampshire Department of Health and Human Services reducing enrollment projections for Medicaid after collecting data from the first month of enrollment changes following the April 2023 end to pandemic-era federal requirements related to continuous enrollment in Medicaid.

The Senate Finance Committee also proposed eliminating $16.4 million from the House’s version of the State Budget dedicated to supporting the off-ramp for enrollees after this continuous enrollment requirement expired.

Higher Education

Funding levels for the University and the Community College Systems are also lower in the Senate Finance Committee’s versions of the State Budget than the House’s version.

General Funding for the University System would still be higher than levels in the current State Budget under the Committee’s proposal, but would drop by $6.4 million relative to the House’s budget. The University System would also lose $1.5 million appropriated for an interoperability lab to study cryptocurrency and blockchain that the Governor proposed and the House approved in its budget. However, the Committee added $3.0 million, to be matched by another $3.0 million from the University System overall, that would be directed at Keene State College and Plymouth State University specifically.

At the Community College System, the Committee proposed reducing the $6.0 million appropriation to support access and affordability of postsecondary education to $3.0 million, and reduced funding for the dual and concurrent enrollment programs by $1.5 million relative to the House’s levels. However, the Committee did propose funding a $1.0 million program to reimburse certain educational costs for first responders engaged in relevant coursework within the Community College System.

Other Key Reduced Or Eliminated Provisions

The Senate Finance Committee also proposed reducing funding by $4.4 million for tuition and transportation aid related to the State’s career and technical education programming. These funds assist school districts in transporting students to regional centers that offer these programs. The New Hampshire Department of Education reported that the limiting factor for enrollment is not currently transportation costs.

Additionally, the Committee voted to reduce funding for the proposed Solid Waste Management Fund relative to the House, and eliminate provision and appropriations for a waste management specialist at the Department of Environmental Services, the removal and storage of books at the New Hampshire State Library, and the proposed statewide bail status system.

Housing Funding and Policy Shifts

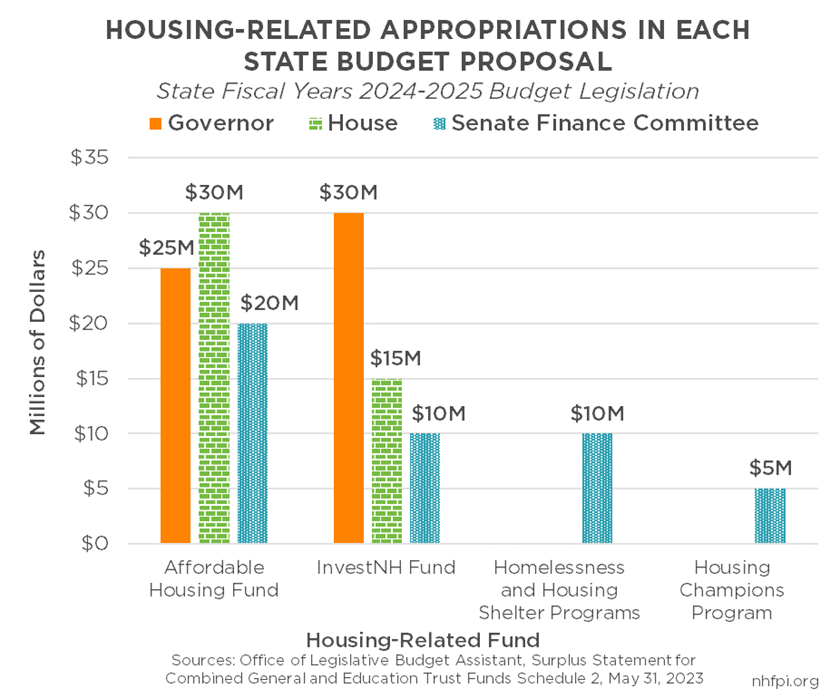

The Senate Finance Committee spread dollars related to housing across more types of programs than the House or the Governor’s versions of the State Budget, while appropriating the same $45 million in additional, one-time spending as the House and less than the $55 million proposed by the Governor. The Committee proposed lowering the Affordable Housing Fund’s appropriation from the House’s $30 million to $20 million, and trimmed the InvestNH Fund’s contribution from $15 million to $10 million. The InvestNH Program would also be expanded to include grants to developers, which the House had not included; the Committee also added requirements for a minimum amount of housing in funded projects to be affordable to occupants under certain income levels.

The Committee’s budget proposes establishing the New Hampshire Housing Champion Designation and Grant Program, which would incentivize municipalities to undertake certain land use and zoning changes, perform water and sewer upgrades, and support walkability and transportation infrastructure to promote workforce housing. This program would be funded with a $5 million appropriation, which is considerably less than the $29 million that was proposed in a separate Senate bill that would have established similar programming.

The Committee would also appropriate $10 million to the New Hampshire Department of Health and Human Services for housing-related purposes, including $8 million to increase public reimbursement rates paid to shelter programs and $2 million to support homeless shelters, cold weather shelters, hotel stays, and other shelter alternatives.

Separately, the Senate Finance Committee also voted to fund congregate housing, provided in part through Medicaid, with a $1.5 million appropriation.

Local Public Education Funding

The Senate Finance Committee proposed a new structure for the State’s education funding formula for local public education. While the House proposal includes a multi-faceted set of targeted aid programs, the Senate Finance Committee would shift the proposal toward the Governor’s originally-proposed model for targeted aid, which would be phased in over a ten-year period to establish a simpler formula.

State projections suggest the Senate Finance Committee’s total education funding formula payments would be about $11.6 million higher than the House’s funding levels during the biennium. Both the House and the Senate Finance Committee proposed boosting base per pupil aid to levels higher than under current law, as well as funding levels for free and reduced-price school meal eligible students, English language learners, and students with special education needs; the Committee matched or exceeded the increases proposed by the House in these areas, bringing the baseline formula levels proposed by the House closer to those proposed by the Governor.

The Committee also voted to eliminate key targeted aid mechanisms proposed by the House. The House would have retained a portion of the Stabilization Grants, which is based on an historical change in funding levels. The House would also retain versions of both Relief Aid, based on free and reduced-price meal eligibility concentrations, and Extraordinary Needs Grants, based on a combination of free and reduced-price meal eligible students and local taxable property values within a community. The House would also re-institute a version of Fiscal Capacity Disparity Aid, which targets aid only based on property values per pupil, and establish Hold Harmless Grants to ensure that no community receives less funding in the next biennium than it would under current law. The Senate Finance Committee would eliminate Stabilization Grants, Relief Aid, and Fiscal Capacity Disparity Aid.

Relative to both the Governor and the House, the Senate Finance Committee would substantially boost funding through the Extraordinary Needs Grants. Maximum funding levels for communities with relatively low property values and a higher number of students enrolled in school meal assistance programming would receive up to an additional $8,500 per pupil eligible for free or reduced-price meals in SFY 2024, and $11,500 in SFY 2025. This method of distributing targeted aid would become more important than in the House proposal; while the House would distribute an estimated $90.6 million through this mechanism during the biennium, the Senate Finance Committee would direct $311.6 million through Extraordinary Needs Grants during the biennium.

The Senate Finance Committee’s Hold Harmless Grants would begin to phase out during the next State Budget biennium, falling 20 percent of their original value each biennium until disappearing completely in SFY 2034. Communities that would receive more than $1.0 million in Hold Harmless Grants in SFY 2025, which would begin dropping in SFY 2026, include Antrim, Berlin, Claremont, Derry, Farmington, Hinsdale, Litchfield, Northfield, Pembroke, Raymond, Sandown, Swanzey, and Weare.

The Committee also proposed devoting a greater percentage of revenue from the State’s two primary business taxes to the Education Trust Fund than the House. While the House would have shifted both revenues and the responsibility for funding services away from the Education Trust Fund and to the General Fund, the Committee’s proposal would retain the current funding responsibilities of the Education Trust Fund with that Fund. The House budget would run a deficit in the Education Trust Find at the end of the next biennium due to sending only 22.5 percent of revenues collected by each of the two business taxes into that Fund, while the Senate Finance Committee would allocate 41 percent of each tax to the Education Trust Fund.

Other Proposed Funding Changes

The Senate Finance Committee’s State Budget proposal would boost funding for projects in other key areas relative to the House’s State Budget proposal, including:

- $11.5 million more than the House, totaling $16.5 million, to boost provider payment rates as part of a system of care targeted at children

- $15.0 million for supporting recruitment and retention bonuses and benefit grants to support the child care workforce

- $2.0 million, bringing the total funds to $4.0 million, for Family Resource Centers

- $1.7 million to support the establishment of a multi-faceted system of care for older adults and adults with disabilities to bolster access to home and community-based services

- $20.0 million in municipal bridge and highway assistance

- $18.0 million to fund the replacement of the Cannon Mountain Aerial Tramway

- $9.7 million for a new drinking water transmission mainline between Nashua and Litchfield

- $4.8 million to support Department of Transportation vehicle and equipment replacements

- $4.0 million to fund programs at the Department of Education to bolster the computer science workforce among teachers, encouraging existing teachers to obtain more credentials and incentivizing workers in the computer science field to become teachers

- $2.0 million in General Fund dollars transferred to support the Fish and Game Fund

- $1.9 million to match federal dollars for public transit investments

- $1.5 million in additional funding for expanded postpartum Medicaid eligibility

- $1.4 million for the Northern Border Alliance Fund, which had been proposed by the Governor and removed by the House, to fund law enforcement activities conducted by State, county, and local police forces to mitigate criminal activity near the Canadian border

Next Steps

The Senate Finance Committee’s budget proposal will go before the full Senate for consideration and any additional amendments. The Senate must pass a version of the State Budget before sending it to the House. The House could either agree with the Senate’s amendments by voting to concur, or ask for a Committee of Conference. If a Committee of Conference occurs, that Committee will produce a final version of the State Budget to be considered by both chambers, without amendments, before the next budget biennium begins and the current State Budget expires on July 1, 2023.

– Phil Sletten, Research Director