By GARRY RAYNO, InDepthNH.org

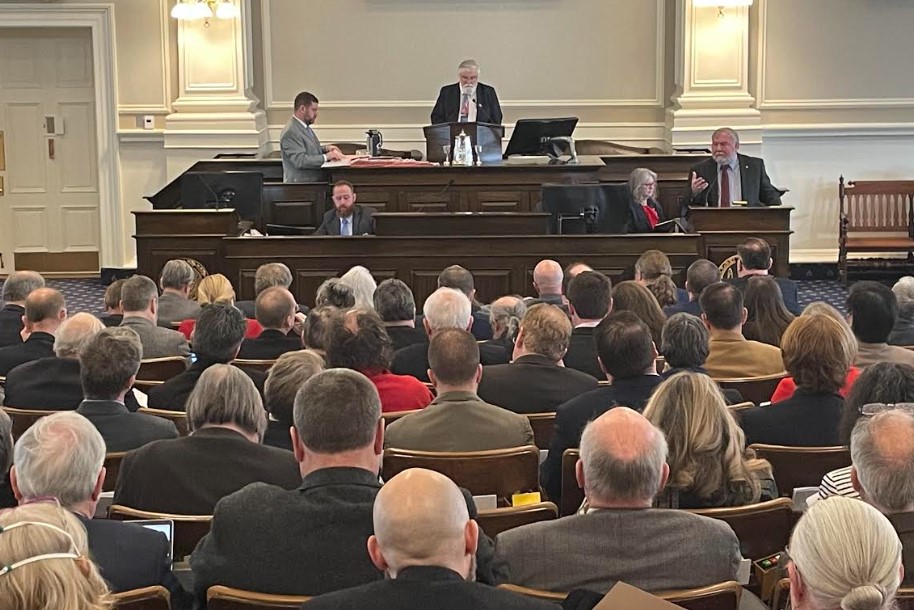

CONCORD — The House failed to reach the needed threshold to send a proposed constitutional amendment to the Senate that would allow state tax dollars to be used for religious schools.

CACR 7 would repeal the Blaine Amendment many states passed in the late 1800s that prohibits state dollars for religious uses including schools, but failed to reach the three-fifth majority needed 192-191.

Many of the bills from the House Education Committee coming before the House Wednesday were tabled, particularly those with committee members deadlocking down party lines 10-10, which would have likely led to debates.

The House did decide on two bills, one dealing with tuitioning students to an approved school outside the district, and the other would increase the number of students eligible for free or reduced lunches.

The proposed constitutional amendment CACR 7 would go against a longstanding state tradition going back 239 years that prohibits the use of tax dollars for religious activities including schools, said Rep. Mel Myler, D-Hopkinton.

The provision in the state constitution “made clear no one should have to pay for another’s religious instruction,” he said, noting it follows the Jeffersonian principle of separation of church and state.

He noted the Blaine amendment adopted by many states around 1877 was at the time anti-catholic and anti-immigrant and was mean spirited, but the similar provisions in the constitution predates the amendment by 100 years.

He said supporters of repealing the amendment will cite several US Supreme Court decisions that overrule the amendment, but those rulings were very narrow.

But the bill’s prime sponsor, Rep. Glenn Cordelli, R-Tuftonboro, said the Blaine amendment is a relic of anti-catholic bigotry which was prevalent at the time including in New Hampshire.

He disagreed that the US Supreme Court rulings on the issue of state tax dollars for religious institutions were narrow, citing several examples.

Cordelli said the provision is unconstitutional now and should be repealed. “It is a stain on our constitution,” Cordelli said.

House Bill 572 increased the income eligibility threshold for the free and reduced lunch program from 185 percent of the national poverty level to 300 percent.

The federal government only pays for the 185 percent level and the state would pay for those above that level.

Rep. Mike Belcher, R-Wakefield, said raising the income level could place the threshold above the median household income in the state, so a majority of students in a school would be in the program.

He said he did an estimate that if 70,000 of the 90,000 students in the state qualified, the state’s share could approach $100 million.

“On top of New Hampshire taxpayers footing the bill,” he said, it would still be “a federally regulated program. . . . It would be the worst of both worlds.”

But Rep. Muriel Hall, D-Bow, said the bill comes at a time when many families are struggling to put food on the table.

“Hunger, that is what this bill is about, child hunger,” Hall said. “For some child, the next meal may be a day away. We can do better than this.”

There has been considerable attention to the state surplus, she said. “This won’t end hunger in New Hampshire but it is a reasonable start.”

The bill passed on a 201-177 vote.

The House also approved House Bill 275, which would allow parents to pay additional money for school tuition if it is more than the cap the school district established to attend an out of district school without those schools like a high school.

The bill was approved on a 201-177 vote.

Education bills tabled were:

House bill 61, which would have repealed the state’s divisive concept law approved two years ago;

House Bill 204, which would limit non-academic school surveys;

House Bill 331, which would have eliminated an income threshold for the Education Freedom Account program;

House Bill 371, which would establish a commission to evaluate and recommend standards for public schools;

House Bill 427, which concerns public comment and inquiry during school board meetings;

House Bill 432, which would require participants in the EFA program to qualify for income thresholds annually;

House Bill 451, which concerns the state board of education prohibition on discrimination;

House Bill 515, which makes small minor changes to the EFA program;

House Bill 516, which concerns freedom of speech and association at public institutions of higher education;

House Bill 538, which would establish a local education freedom account program;

House Bill 539, which would prohibit vaccination clinics at schools;

House Bill 552, which would make incentive grants for school districts that improve in certain assessment scores;

House Bill 603, which would require criminal background checks for education service providers under the EFA program;

House Bill 621, which would determine how state funds are handled if a student leaves the EFA program;

And House Bill 629, which would establish a student bill of rights.

The bills approved by the House now go to the Senate for action.

Garry Rayno may be reached at garry.rayno@yahoo.com.