Power to the People is NH Consumer Advocate D. Maurice Kreis’ column that is posted every three weeks. Kreis and his staff of four represent the interests of residential utility customers before the NH Public Utilities Commission and elsewhere.

By D. Maurice Kreis, Power to the People

King George III of England did not keep a diary, and so it is a myth that on July 4, 1776, he scribbled an entry concluding that “nothing of importance happened today.”

King George III by Allan Ramsay

But if George were alive now, living in New Hampshire, and a residential electric customer of Eversource, he could well have penned such a diary entry last Thursday. It would have been especially appropriate if he were singly focused on where his electricity comes from and how much he pays for it.

True, the state’s Site Evaluation Committee (SEC) dropped a bombshell on Thursday afternoon by taking a surprise unanimous vote to reject Eversource’s Northern Pass transmission project and then suspending its public deliberations before even reaching all of the issues the SEC is required by statute to consider.

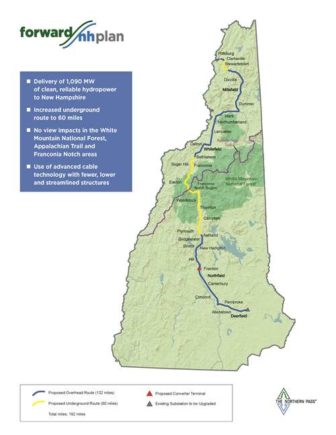

True, Eversource set a new standard for intemperance in corporate public relations by declaring it was “shocked and outraged” by the decision. True, those who think the unburied portions of the 192-mile transmission line would be an ugly slash through the middle of our verdant state had reason to celebrate.

But for New Hampshire ratepayers, as ratepayers, it was just another Thursday.

D. Maurice Kreis

Northern Pass, if built, would be a giant extension cord. Its purpose is to deliver 1090 megawatts of hydroelectric power generated in faraway parts of Quebec to consumers in Massachusetts. Just days before the SEC vote, Eversource was declared the winner of a bidding competition to provide Bay State customers with energy designed to meet aggressive renewable energy procurement targets mandated by lawmakers at the State House in Boston.

Like it or not, there are no such renewable procurement requirements for electricity in New Hampshire. (We have a renewable portfolio standard but that requires electricity providers to buy tradeable renewable energy credits, not enter into binding longterm energy contracts.)

Skeptics, cynics, and business rivals of Eversource condemned the news from Massachusetts. They pointed out that as an electric utility with lots of customers in the Bay State, Eversource played a prominent role in the committee that picked Northern Pass as the winner there. The game is rigged, they concluded angrily as they geared up for what they assumed would be a Northern Pass victory at the SEC.

Final proposed route for Northern Pass

Rigged or not, it was a Massachusetts game. As approved by the Federal Energy Regulatory Commission, which oversees interstate electricity transmission as well as wholesale power markets, Northern Pass is a “participant funded” project. Its costs would not go into the regional transmission rates paid by all ratepayers in New England. Rather, the provincially owned mega-utility and energy exporter Hydro-Quebec would pay those costs and, presumably, recover them by selling electricity to utilities in Massachusetts.

This is not to claim a total absence of ratepayer effects in New Hampshire should Northern Pass be built in spite of last week’s SEC vote.

The staff of the Public Utilities Commission (PUC) got Northern Pass to agree to contribute $2 million a year to energy efficiency programs for a decade in exchange for gaining the required legal authority to operate as a public utility in New Hampshire.

Separately, my office worked with the PUC staff to get Northern Pass to commit another $15 million in payments, spread out over 40 years, as part of a deal to approve the lease by Northern Pass of space on an existing transmission right-of-way that had been paid for by New Hampshire ratepayers. We had visions of using the latter fund to help pay for the development of demand response programs, energy storage, and other alternatives to more new transmission projects.

There was also a fish that got away. Responding to criticism from candidates in the 2016 election that no energy from Northern Pass would benefit the Granite State, Public Service Company of New Hampshire (still the legal name of Eversource’s New Hampshire subsidiary) entered into a power purchase agreement for 100 megawatts’ worth of Hydro-Quebec power to be imported via the Northern Pass line.

Two fatal flaws consigned that particular agreement to oblivion.

Eversource insisted that the terms of the deal remain confidential. And the deal itself was illegal. Or, more precisely, the PUC correctly ruled that in the wake of the 1996 electric industry restructuring statute, electric utilities can no longer enter into power purchase deals and force all customers (including those who obtain electricity from competitive suppliers) to take on the risk of such agreements proving over time to be bad deals.

Finally there is the $62 million that Eversource claimed New Hampshire customers would save each year because Northern Pass power would reduce wholesale electricity prices throughout New England. Basic economic notions of price equilibrium would indeed suggest that if you add 1090 megawatts of supply without reducing demand, prices will decline.

But the region’s electricity markets are Rube Goldberg machines, the better to shield the region’s ratepayers and stakeholders from the brutal law of supply and demand. So how Northern Pass would affect regional prices is no simple thing to determine. This was apparently a hotly contested issue in the SEC hearings, in which the Office of the Consumer Advocate was not involved.

The bottom line: A couple of relatively small funding streams to be paid out over many years, a power purchase agreement that turned out to be illegal, and a highly disputed claim about wholesale price suppression amount to a relatively insignificant amount in comparison to the total amount Granite Staters pay each year for electricity. The cost to ratepayers of not getting Northern Pass is small.

Still, there may be big implications for ratepayers in the long term.

One would hope that the SEC’s decision would point Eversource and other industry payers in the direction of more local and small-scale projects when it comes to needed improvements to our energy infrastructure. Energy efficiency, demand response, micro-grids, battery storage, and small-scale generation facilities are the kind of infrastructure that does not require SEC approval, yet all count.

Hopefully, those who are angry at the SEC will cool off and realize that.

Northern Pass isn’t dead yet. The SEC must issue a written decision. There will be rehearing requests and, thereafter, appeal to the New Hampshire Supreme Court. But regardless of the fate of the project, if last week’s surprise plot twist changes the energy conversation in New Hampshire then last Thursday will have been a significant day for New Hampshire’s electricity customers.

If not, then the correct diary entry is indeed that nothing of importance happened on February 1.

InDepthNH.org co-publishes this column with Manchester Ink Link and shares it with all news outlets. For more information about the nonprofit InDepthNH.org, which is published online by the New Hampshire Center for Public Interest Journalism, contact Nancy West at nancywestnews@gmail.com or call 603-738-5635