By GARRY RAYNO, InDepthNH.org

CONCORD — Government assistance related to the pandemic helped drive state personal income growth in the first quarter to its highest level since 1948 when the income indicator was first used, according to a study released Tuesday by the Pew Charitable Trusts.

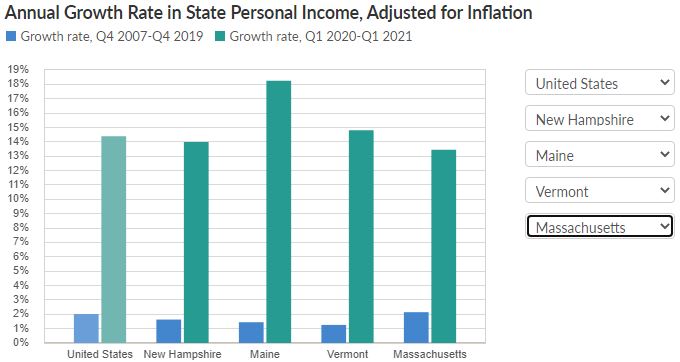

While New Hampshire experienced record income growth in the first quarter, it lagged behind its Northern New England neighbors and the national average.

That is not unique as income growth in New Hampshire has been below the national average from 2007 until 2020, 2010 and 2016 the only exceptions, according to the study.

“More than half of states recorded their strongest personal income growth ever in the first quarter of 2021 as the economic recovery accelerated,” said Barb Rosewicz, Mike Maciag and Joe Fleming, who wrote the report. “Multiple rounds of pandemic-related government benefits drove year-over-year gains in every state, while earnings—the bulk of personal income—also edged up in most states. The sharp rise in total personal income will be temporary, however, as federal relief payments taper off.”

The national average for personal income growth for the first quarter of 2021 was 14.39 percent, while New Hampshire’s was 13.98 percent.

Maine led New England with a growth rate of 18.2 percent, Rhode Island’s was 15.4 percent, and Vermont’s was 14.8 percent.

Massachusetts’ income growth rate was below New Hampshire’s at 13.4 percent, and Connecticut’s rate of 9.5 percent, was among the lowest in the country.

Other low growth rates were New York, also at 9.5 percent, and Wyoming at 9.4 percent, while the highest rates were in Utah, Idaho, and West Virginia, followed by Michigan and Mississippi, all above 19 percent.

State personal income includes residents’ paychecks, Social Security benefits, employers’ contributions to retirement plans and health insurance, income from rent and other property, and benefits from public assistance programs such as Medicare and Medicaid, among other items.

Personal income does not include unrealized capital gains.

The Pew Charitable Trusts used data collected by the U.S. Bureau of Economic Analysis Personal Income by State data series with data collected June 22 and adjusted for inflation.

State personal income is used to assess economic trends. The data “matters to state governments because tax revenue and spending demands may rise or fall along with residents’ income,” according to the report’s authors. “It sums up all the money that residents receive from work, certain investments, income from owning a business and property, and government assistance, including the extra federal aid provided in response to the pandemic, as well as benefits from employers or the government.”

Over the years, personal income growth generally increases, but recessions can reverse the trend such as in 2009 and 2013 when it decreased nationally and in New Hampshire, according to information contained in the report.

The average change in personal income growth in the country exceeded 3 percent in 2011, 2014, 2015 and in 2020 when it was 4.9 percent. In New Hampshire it was 3 percent in 2010 and 2016, and was 2 percent in 2019, the last full year before the pandemic. The growth rate for 2020 for the state was 3.8 percent with the injection of federal aid.

The federal infusion of money will end soon however, and with it, the boost in personal income, as the pandemic related assistance is set to decline in the second quarter, according to the report.

The report notes, “More recent national estimates from the U.S. Bureau of Economic Analysis show that U.S. personal income dropped significantly in the second quarter of 2021, compared with the first quarter.”

The authors warn state personal income should not be seen totally as wage growth as wages and salaries account for about half of the United States’ personal income.

And the authors said the state’s personal income growth should not be seen as a “measure of how much the income of average residents has changed.”

The portion of personal income from earnings—which includes wages from work, employer health benefits, and business profits—also increased, although by far less than total government assistance, according to the report.

Earnings were $177 billion higher in the first quarter of 2021 than a year earlier, compared with a $2.8 trillion increase in income from all sources of government assistance.

However, earnings increased for the third consecutive quarter and are above pre-pandemic levels. All but 10 states experienced year-over-year gains, according to the report.

Earnings plummeted during the pandemic.

The authors noted that state personal income is but one measure of economic activity.

“Looking at state gross domestic product, which measures the value of all goods and services produced within a state, would yield different insights on state economies,” the authors said.

Garry Rayno may be reached at garry.rayno@yahoo.com.