– Financing supports new construction and preservation of affordable rental housing –

(Bedford, August 19, 2021) – To help meet the critical need to build and preserve affordable rental housing for our state’s workforce and other residents, funding for 16 affordable multi-family rental housing developments was approved by the New Hampshire Housing Board of Directors during the fiscal year ending June 30, 2021 (FY21).

The allocation of Low-Income Housing Tax Credits (LIHTC) and other federal and state funding to these projects will produce or preserve almost 1,000 units of affordable rental housing in the state’s communities.

LIHTC-funded housing accounts for about 95% of publicly funded workforce housing produced in New Hampshire. This federal program is an important public/private financing tool that encourages developers and investors to create affordable multi-family housing for low- and moderate-income families by using tax credits to leverage private equity investment in these properties. Over 25 years, LIHTC financing has added nearly $1 billion of investment in New Hampshire. The housing credit program leverages ten times the amount awarded: in this recent round, $5 million in LIHTC awards will yield nearly $50 million in private capital to develop affordable housing in the state.

Other funding sources that New Hampshire Housing administers for the construction and preservation of affordable multi-family housing include the federal HOME program and Housing Trust Fund, the state Affordable Housing Fund, and tax-exempt bond financing. In FY21, more than $21 million in tax-exempt bond funding was allocated.

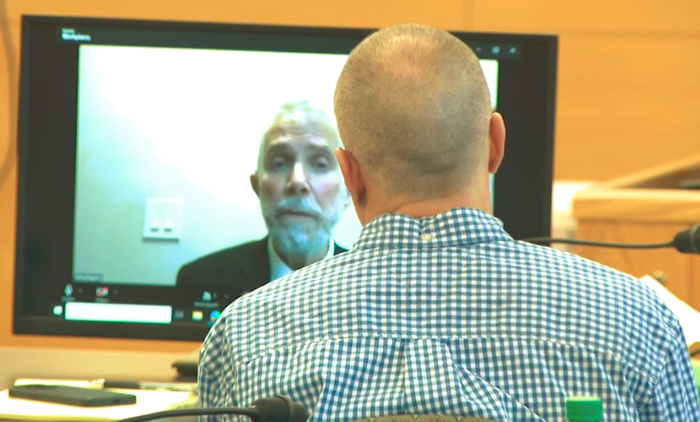

The importance of tax credits to create affordable housing is underscored by private developer David Lemieux, whose Apple Ridge Apartments in Rochester are being constructed in three phases using LIHTC funds. There will be 102 apartments when completed. “In 2019, we developed and built much needed affordable units in Phase I,” Lemieux, principal at McIntosh Development, noted. “New Hampshire Housing provided low-rate construction financing for the project, as well as permanent loan financing. Now we are heading into phase II, and the LIHTC program is again making this possible.”

“The production of new housing helps meet an urgent need in the state, and supports the state’s thriving economic development climate,” noted Dean Christon, executive director of New Hampshire Housing. “The state and federal funding sources that New Hampshire Housing provides are essential financing tools for public and private developers to create and renovate affordable rental housing throughout the state.”

New Hampshire Housing manages the financing of new multi-family rental unit construction, and refinances and recapitalizes existing properties to preserve affordable housing units in the state. Our programs address affordable and workforce housing needs, as well as supportive housing for vulnerable and underserved populations including veterans, persons with substance use disorders, the formerly incarcerated, and individuals with intellectual and developmental disabilities.

| NEW CONSTRUCTION & ADAPTIVE REUSE (Adaptive reuse repurposes buildings into housing, e.g., from schools, stores, commercial buildings, churches, etc. into multi-family housing) | |

| CLAREMONT Sullivan House Sullivan County | SUPPORTIVE HOUSING 28 units in former newspaper building renovated to serve as transitional housing for individuals formerly incarcerated and recovering from substance use disorders |

| CONCORD Village Street (Rosemary’s Way) CATCH Neighborhood Housing | GENERAL OCCUPANCY 42 units in six townhouse-style buildings located in the Concord village district of Penacook |

| PORTSMOUTH Court Street Workforce Housing Portsmouth Housing Authority | GENERAL OCCUPANCY 64 units in downtown Portsmouth |

| DURHAM Bagdad Woods Housing Initiatives of NE Corp. | AGE-RESTRICTED 26 new units added, 40 units preserved HUD project-based rental assistance (no more than 30% of household income for rent & utilities) |

| GOFFSTOWN Woodland Village I & II Dakota Partners, Inc. | GENERAL OCCUPANCY Phase I (42 units) & II (32 units) = 74 units total |

| LEBANON Heater Landing Lebanon Housing Authority | GENERAL OCCUPANCY 44 units with resident services coordinator on site; will seek National Green Building Standard Gold certification |

| LEBANON 12 Green Street Visions for Creative Housing Solutions | SUPPORTIVE HOUSING 5 units serving 11 adults with developmental disabilities Acquisition & rehab of two existing buildings |

| NASHUA Nashua Soup Kitchen & Shelter NSKS | SUPPORTIVE HOUSING 11 units – adaptive reuse – historic preservation of a former school into 11 units of permanent supportive housing for persons experiencing homelessness, with facilities for temporary shelter and service delivery |

| ROCHESTER Apple Ridge Apartments II McIntosh Development, LLC | GENERAL OCCUPANCY 34 units (total number of units phases I – III = 102 units) |

| PRESERVATION (Housing that is refinanced and improved to extend affordability period; or created or preserved for affordability) | |

| AMHERST Parkhurst Place Souhegan Valley Interfaith Housing | AGE-RESTRICTED 42 units Refinanced |

| LACONIA Wingate Village Winn Development Co. | GENERAL OCCUPANCY 100 units |

| MANCHESTER 434 Union Street (formerly Angie’s Place) Families in Transition | SUPPORTIVE HOUSING 11 units – conversion of boarding house into permanent supportive apartments for individuals experiencing homelessness |

| MEREDITH Harvey Heights II Lakes Region Community Developers | GENERAL OCCUPANCY 25 units |

| NASHUA Bronstein Redevelopment Nashua Housing & Boston Capital Development | GENERAL OCCUPANCY 166 units – phased replacement of existing public housing & addition of new units (216 units total) |

| SEACOAST Properties owned by The Housing Partnership | GENERAL OCCUPANCY 40 units (within 10 buildings on various sites) |

| SOMERSWORTH Fillion, Nadeau & Charpentier Apartments Somersworth Housing Authority | GENERAL OCCUPANCY 169 units within 3 public housing properties to be renovated over 2 years through HUD’s Rental Assistance Demonstration (RAD) program, which ensures apartments remain permanently affordable. Households pay no more than 30% of their income for rent and utilities. |

- 2021 New Hampshire Residential Rental Cost Survey Report

- Housing Market Reports

- NHHFA FY20 Annual Report

- New Hampshire housing market economic and demographic data

/

About New Hampshire Housing: As a self-supporting public corporation, New Hampshire Housing Finance Authority promotes, finances and supports affordable housing. NHHFA operates rental and homeownership programs designed to assist low- and moderate-income persons with obtaining affordable housing. We have helped more than 50,000 families purchase their own homes and been instrumental in financing the creation of more than 15,000 multi-family housing units.

NewHampshireHousing.org | #NHHFAHousing | @NewHampshireHousing | @NHHFA

– – – – – – – – – – – – – – – – – – – – – – – – – – – – –

GRACE LESSNER

Director of Communications & Marketing

New Hampshire Housing Finance Authority

PO Box 5087 | Manchester, NH 03108

(603) 310-9371 (d) | (603) 674-2023 (c)

glessner@nhhfa.org | NHHFA.org