By GARRY RAYNO, InDepthNH.org

CONCORD — Gov. Chris Sununu Thursday presented a budget that would maintain funding for numerous social service programs, increase spending on mental health, combine the university and community colleges systems, and cut some taxes.

Under Sununu’s projected budget, state revenues are projected to increase 5.5 percent over the current biennium, while he would use about $30 million of the state’s rainy-day fund to balance the current biennium’s budget.

He proposed doubling the cap on the rainy-day fund from 5 to 10 percent of revenues as a way to better prepare for the future in light of the coronavirus pandemic that upended the state a year ago.

Sununu proposed a two-year operating budget of $13.36 billion of total funds, a 5.6 percent increase over the current budget ending June 30.

In general and educational fund spending, Sununu’s proposed budget would spend $5.45 billion, a $41 million decrease from the current spending plan.

The state faces a projected $50 million shortfall for the biennium, Sununu said, although projections last spring were for as much as a $350 million deficit.

“Unlike other states across the country, which are now raising taxes on businesses, taxing out-of-state workers, or enacting draconian budget cuts to cover their massive deficits,” Sununu said, “New Hampshire managed to mitigate the worst financial impacts of the pandemic without raising taxes.”

When the pandemic turned the state’s economy upside down, he said he instituted hiring freezes and halting non-essential spending, while ensuring agencies could provide critical services to those who needed them.

“Through the strategic reopening of our economy,” Sununu said, “we ensured that vital programs at the state level wouldn’t be gutted and essential services would be maintained.”

Reaction to his budget proposal was partisan as Republicans praised his budget as living within the state’s means while protecting business, working families and taxpayers, but Democrats say the devil is in the details and despite assurances it wouldn’t, his budget would once again downshift millions of expenses to local property taxpayers.

“I fully support the governor’s proposal to help our struggling Main Street businesses, hardworking families and property taxpayers recover from the pandemic,” said Senate President Chuck Morse, R-Salem. “Lowering taxes will help people get back to work and grow our economy while providing additional assistance to cities and towns will help struggling property taxpayers.”

“Gov. Sununu’s budget appears to be fulfilling several major Republican promises to the people of New Hampshire including tax cuts that will benefit our citizens and small businesses, increased government efficiency, and a voluntary paid family leave plan that does not create an income tax,” said House Speaker Sherman Packard, R-Londonderry.

But Democrats had a different take on what Sununu proposed.

“I have learned over many terms in the Finance Committee that the devil is always in the details,” said Rep. Mary Jane Wallner, D-Concord, the ranking Democrat on the House Finance Committee. “What I heard today was that this budget proposal would do a lot of downshifting back to our local communities and our local property taxpayers. To be clear, if we reduce the amount of money we are investing in our schools and cities and towns, local property taxpayers will be forced to make up the difference.”

Democratic party chair Raymond Buckley echoed those comments.

“He unveiled a budget full of empty promises that leaves hard-working families behind and will leave future generations of New Hampshire struggling to catch up,” Buckley said. “Let’s be clear about what Sununu’s budget does — It offloads state responsibilities onto the backs of already overburdened local property taxpayers — including struggling Main Street small businesses — for the benefit of out-of-state corporate special interests.”

Social Services

“These are uncertain times, and this pandemic has exacerbated our mental health crises,” Sununu said, “especially for kids.”

This budget continues levels of funding for mental health programs with additional money to reduce the number of people in mental health crises held in hospital emergency rooms and for mobile crisis teams.

Sununu’s proposed budget also provides $3 million dollars in services for kids including additional school counselors, peer-to-peer and buddy support programs, and making children aware of where to go and what to do when they are feeling low.

Additional money will be available for seniors and veterans’ mental health programs in his budget as well.

Sununu said he wants to continue the progress made in child protection services and programs for the developmentally disabled.

He also praised the state’s “hub and spoke” program addressing substance abuse noting opioid deaths fell in New Hampshire last year, while they increased across the country.

Sununu also proposes to maintain the increase in funding for sexual and domestic violence treatment and prevention programs.

And he said he will go forward with the second 3.1 percent Medicaid provider rate increase that was included in this biennium’s budget, but halted when the pandemic hit.

Education

Sununu said he intends to maintain the additional money lawmakers included in this biennium’s budget for public education. The current budget stopped the reduction in stabilization aid and returned it to its original level and included additional money for poor communities where poverty levels are higher than average.

“Despite the pandemic and slight revenue shortfalls, we are not letting up — we are not cutting education spending,” Sununu said. “My budget ensures that we spend more money per child on public education than ever before.”

Due to the pandemic, public schools are facing losing $90 million in state aid because enrollment drops as many parents removed students from public schools and due to a change in federal requirements for the free and reduced lunch program.

Sununu addressed the loss due to free and reduced lunch changes, but not enrollment.

He said the state would change how it determines state aid based on the free and reduced lunch program so no district would be left behind.

But Jeff McLynch of the NH Schools Fair Funding Project said the governor’s budget proposal falls short.

“Based on an initial review of the Governor’s budget,” McLynch said, “total state education aid would fall by more than $100 million between the current biennium and the next if his plan were to become law.”

Sununu also proposed using $30 million of the surplus in the Education Trust Fund for capital projects like building aid, energy efficiency projects and alternative fuel buses.

“Now all these opportunities we are creating for our kids can’t be fully achieved if they are sitting at home, remote learning,” he said, noting the federal government is providing $250 million to help schools transition through the pandemic.

But he said kids need to be back in schools.

Revenue Sharing

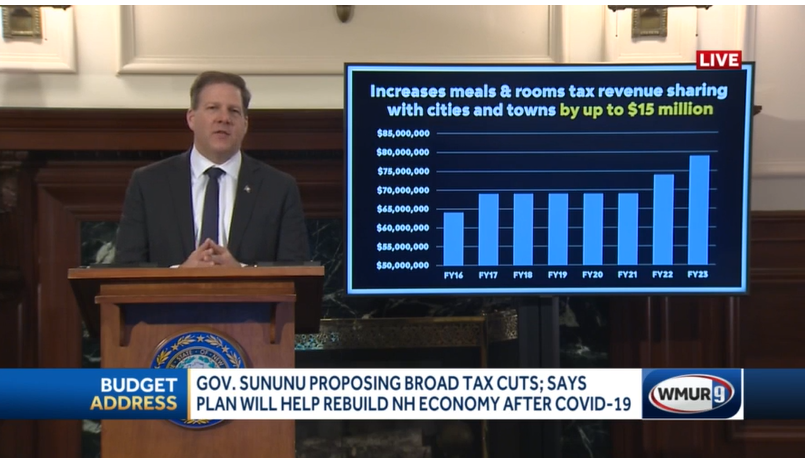

Sununu proposed an additional $15 million from the rooms and meals tax receipts go to municipal revenue sharing.

Lawmakers added $40 million in revenue sharing in the current biennium’s budget, after cities and towns had not received any program money since the Great Recession in 2009.

Higher Education

Sununu said the pandemic has forced leaders to look at new solutions for higher education so he is proposing combining the university and community college systems.

“This is the future of higher education,” Sununu said. “This evolution is not to the benefit of any one system or any singular college, but to every student across our state.”

The pandemic accelerated the move to a more flexible higher education system that needs to be more student friendly, he said.

Facing declining enrollments due to the pandemic, he said each of the system’s 11 institutions worked separately to mitigate the impact.

“This merger will enable a combined system to innovate in a coordinated way,” Sununu said. “My budget proposal takes the first steps by merging the two boards.”

Sununu resurrected his proposal from two years ago to provide $10 million in debt relief for college graduates who stay and work in New Hampshire.

The program would focus on graduates in high demand fields like health care, biotechnology and social work.

Tax Cuts

Sununu’s budget reduces the meals and rooms tax from 9 to 8.5 percent, cuts the interest and dividends tax and phases it out over five years, and lowers the business enterprise tax from .6 to .55 percent.

And under his budget proposal, he would raise the filing threshold for the BET to $250,000, which would free thousands of small businesses from filing or paying the tax.

The change would also allocate 90 percent of the BET revenue to the Education Trust Fund.

Sununu did not propose lowering the rate of the business profits tax, which bills before the House and Senate would do. The levy largely on multi-state and international companies, is the single biggest source of business tax revenue.

Many of the large corporations who pay the majority of the tax, have not been impacted by the pandemic as small businesses have and those revenues have buoyed business tax receipts for the state since the pandemic hit.

Sununu also proposed creating a new Department of Energy combining most of the Public Utilities Commission’s functions with the Office of Strategic Initiatives.

He said the change would keep regulatory functions separate from programs and policies and would fund the Office of Offshore Wind Industry Development for the first time.

And he is proposing a voluntary paid family leave program that would originate with state workers and eventually lower premiums for private companies and individuals.

And he also said he wants to improve law enforcement accountability by funding the Public Integrity Unit within the Attorney General’s office that would review misconduct complaints.

Sununu also said he would invest in new programs for Police Standards and Training and create a $1 million matching fund for local law enforcement agencies to purchase body and dashboard cameras.

The House Finance Committee next week will begin the legislative budget process with a deadline of April 8 to finish its version of the two-year operating budget.

Garry Rayno may be reached at garry.rayno@yahoo.com.