By GARRY RAYNO, InDepthNH.org

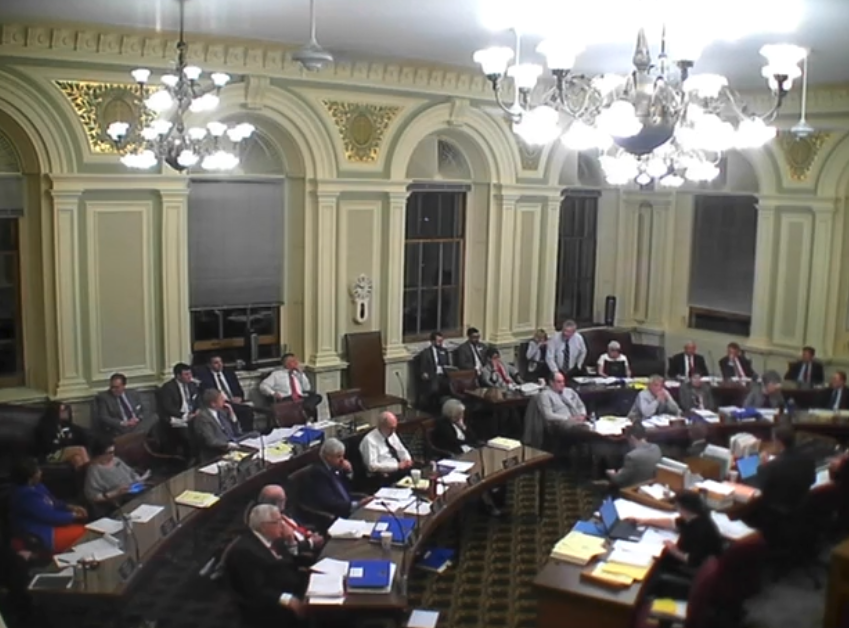

CONCORD — Among the State House’s 200th anniversary celebration activities Thursday, the Senate approved a $13.33 billion budget boosting state education aid the day after a superior court judge declared the current funding system unconstitutional.

However, the debate on the budget drew stark lines between Democrats and Republicans as they came to loggerheads over two keys to the proposed budget, paid family and medical leave and business tax rates, amid threats of a gubernatorial veto.

“We’re at a showdown,” said Sen. Jeb Bradley, R-Wolfeboro, “but it doesn’t have to be.”

But Democrats said they have a different definition for success with the state’s booming economy not serving everyone.

Sen. Jon Morgan, D-Brentwood, said past budgets have not served many working people and have led to a mental health crisis, crumbling infrastructure and high debt for students graduating from state colleges.

“What about the families and the people of New Hampshire,” Morgan said. “That is the priority.”

While some sections of house bills 1 and 2 received unanimous support, other sections were debated at length such as taxes, Medicaid expansion and paid family and medical leave with senators at each other’s throats. There were accusations of bad faith and broken promises during the seven hours of debate lasting into the night.

Receiving unanimous support were increased state aid for the university and community college systems, child protection, developmentally disabled services, mental health and substance abuse treatment, recovery and prevention, New Hampshire State Hospital trust funds, the Attorney General’s Office, boosting education aid to public schools and various other programs.

The remainder of house bills 1 and 2 were approved on partisan 14-10 votes while 20 Republican amendments targeting fees, tax changes, mental health facilities, and family and medical leave were defeated, all but one down party lines.

After the debates, the senators left hoping the two-year budget plan will elude Gov. Chris Sununu’s veto, but that is unlikely unless changes are adopted during negotiations with the House later this month.

“We have built a document that is sustainable and a document that takes care of the people of New Hampshire,” said Senate Finance Committee chair Lou D’Allesandro, D-Manchester. “This is a budget that I am proud of and this is a budget that reflects values, my values and I hope for everyone in this body.”

“Our job, our job is to produce something that reflects our values, our values,” D’Allesandro said. “This budget does a lot, working together we can make it better.”

Former senate president and finance committee chair, Sen. Chuck Morse, R-Salem, said the budget is not sustainable and sets the state on a road to an income tax.

“I’m concerned today the promises being made in this budget are not sustainable. I’m concerned about the taxation used in this budget,” Morse said. “We’re voting on a product I don’t believe is sustainable without an income tax in the next budget, something I can’t support and something the governor has made clear he can’t support.”

He focused on Medicaid expansion, which serves 51,000 low-income adults, noting a bipartisan agreement establishing the program prohibited using general fund money to pay the state’s share. The federal government pays 90 percent of the cost and currently insurance companies and hospitals pay the state’s 10 percent share.

A provision in House Bill 2 would allow general fund money to make up any shortfall in the Medicaid expansion trust fund because of rate increases for service providers.

This is the most egregious thing in this budget, Morse said.

“I will ask the governor to veto a budget that puts the people on New Hampshire on the hook,” Morse said. “We all agreed not to open ourselves up to general fund expenditures in that category. It is absolutely wrong.”

He said lawmakers should review the program and see what is working and what is not and change the program.

“To suggest this senator doesn’t give a damn is wrong, absolutely wrong,” Morse said.

Senate Majority Leader Dan Feltes, D-Concord, said the bill takes a reasonable approach to deal with a possible shortfall in the trust fund that could end coverage for 51,000 granite staters.

That is what is important, not to threaten the health care of 51,000 people, he said.

“You cannot accuse anyone here of bad faith,” said Feltes.

Speaking to the budget, he said the Senate budget moves the state forward without new taxes or fees.

He said the Senate plan addresses the crisis created by the 2011-12 biennial budget that slashed state aid to higher education and to behavioral and mental health services that propelled the state into the current opioid epidemic and the shortage of mental health services.

And Feltes said the budget addresses the growing crisis facing the middle class with stagnant wages and increasing property taxes through job training, economic development programs and more money to cities and towns.

But Morse argued the budget increases business taxes by $90 million, saying it is not a freeze, and he said the paid family and medical leave is an income tax.

“This has been an assault on what makes the economy go,” said Bradley. “This would protect the New Hampshire advantage,” he said referring to allowing business tax rate reductions to go down instead of freezing them at 2018 calendar year levels.

“Keep taxing businesses right out of New Hampshire, keep on regulating them right out of New Hampshire,” he said. “We are at a standoff here tonight.”

But Feltes said businesses are taxed on the previous year’s operations and that would not be an increase and he said the family leave program uses a premium like one paid for unemployment insurance.

“Our

companies’ biggest problem is lack of workforce,” said Sen. Jeanne Dietsch,

D-Peterborough. “If you want to talk about competitiveness, it is through

innovation.”

Republicans

argued the budget is not sustainable and has a structural deficit that spends

all the state surplus built up over the past two fiscal years.

But Feltes and D’Allesandro both said the budget is balanced and sustainable and uses surplus funds just as every other budget does when it is available.

Morse said there are two things that prevent the Senate from having bipartisan support, the business tax rates and the family and medical leave act.

The budget uses a projected surplus of $161 million to offset higher spending in both fiscal years than general fund revenues raised but would result in a $24 million surplus at the end of the biennium when $10.6 million of that surplus would be transferred to the state’s rainy day fund.

Sununu’s proposed budget would have $137.3 million in the rainy day fund, while the Senate plan would have $125.7 million and the House plan $116.7 million.

Education Funding

The $5.5 billion general fund budget plan includes about $95 million in additional state aid for school districts by restoring stabilization grants to their original level after three years of 4 percent annual cuts, and instituting capacity aid to help the state’s most property poor school districts. And it includes a commission to study the current cost of an adequate education and the most effective and efficient way to distribute state aid.

The Senate plan removes a provision included in the House budget to increase aid to districts with high rates of poverty, making it less generous than the House’s.

The House education funding proposal would have raised $160 million in additional state funds for education aid.

Key Changes

The Senate budget proposes a 6 percent increase in Medicaid provider rates costing about $60 million, and increases case workers, supervisors and specialists at the Division for Children, Youth and Families for child protection. Additional money is included for housing.

The Senate budget includes $40 million over the two years of the biennium for municipal revenue sharing while the House proposed $12.5 million in the second year. D’Allesandro said the revenue sharing plan has absolutely “no strings attached.”

The budget includes $17.5 million for a new Secure Psychiatric Unit.

Tax Changes

The Senate budget changes the business profits tax apportionment from overall business activity within the state to single sales, which will increase taxes on out-of-state businesses selling into the state but reduce taxes for in-state business that sell out-of-state.

And the Senate approved conforming the state business taxes to the new federal tax laws. The two changes are expected to produce an additional $45 million over the biennium.

Including vaping under the state’s tobacco tax, and pre-paid calling cards under the communications tax are expected to increase revenues by $7.5 million over the biennium.

Lawmakers have until July 1 to approve a new budget when the next biennium begins. If no agreement is reached by that date a continuing resolution is likely, allowing agencies to spend at their current levels.

Garry Rayno may be reached at garry.rayno@yahoo.com